Bengaluru ranks 26th in Knight Frank Prime Global Cities Index Q2

Aug 17, 2020

Mumbai (Maharashtra) [India], Aug 17 : Bengaluru is the 26th fastest-growing prime residential market in the world in terms of annual price appreciation, according to Knight Frank's prime global cities index Q2 2020 released on Monday.

It said the premium micro-markets of the city recorded a rise of 0.6 per cent in annual capital value change in Q2 to an average price of Rs 19,727 per square feet.

New Delhi ranked 27th on the global index with a 0.3 per cent rise in terms of annual capital value change in the prime residential market to an average price of Rs 33,625 per square feet in Q2.

Mumbai's prime residential market ranked 32nd, registering a decline of 0.6 per cent with an average price of Rs 64,388 per square feet.

Prime residential property is defined as the most desirable and most expensive property in a given location, generally defined as the top 5 per cent of each market by value.

The prime global cities index is a valuation-based index tracking the movement in prime residential prices in local currency across 40-plus cities worldwide using data from Knight Frank's global research network.

Of the 20 cities that witnessed a decline in prime residential prices in Q2, nine were in Europe, seven in Asia, two in Australasia, one in the Middle East and one in Africa.

Manila leads the index with prime home prices rising by 14.4 per cent over the 12 months to June followed by Tokyo (8.6 per cent) and Stockholm (4.4 per cent). Bangkok was the weakest-performing global city in the year to June with luxury home prices falling by 5.8 per cent.

While Bengaluru and Mumbai moved up by one place in Q2, Delhi gained five places in the same period.

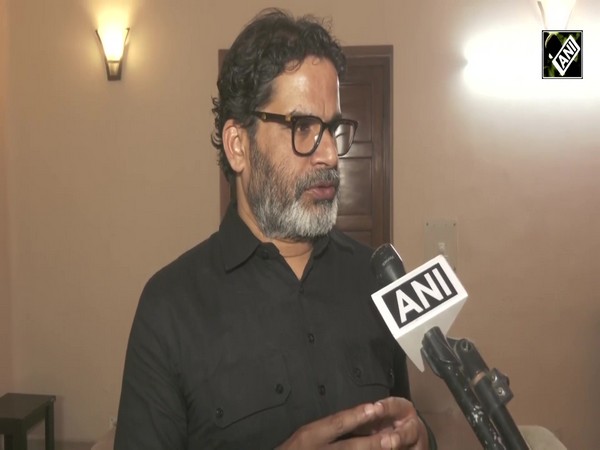

The pandemic infused economic stress has engulfed the global markets with a fear of uncertainty, said Shishir Baijal, Chairman and Managing Director at Knight Frank India.

"Ultra-rich buyers around the world are seen deferring the high premium purchase of a prime residential asset class and preferring investments in liquid assets, primarily gold and cash equivalents," he said.

"With the expected price correction and an uptick in sentiment depending on the news related to vaccine discovery, buyers with adequate liquidity will find value to enter the prime residential asset class in India."