Centre can lower royalties to minimise impact on mining companies post SC ruling: Ambit Capital

Aug 20, 2024

New Delhi [India], August 20 : Ever since the Supreme Court ruled that states can levy taxes on mining retrospectively from April 1, 2005, experts have been arguing that operating costs of Indian mining companies are likely to rise significantly post the apex court ruling.

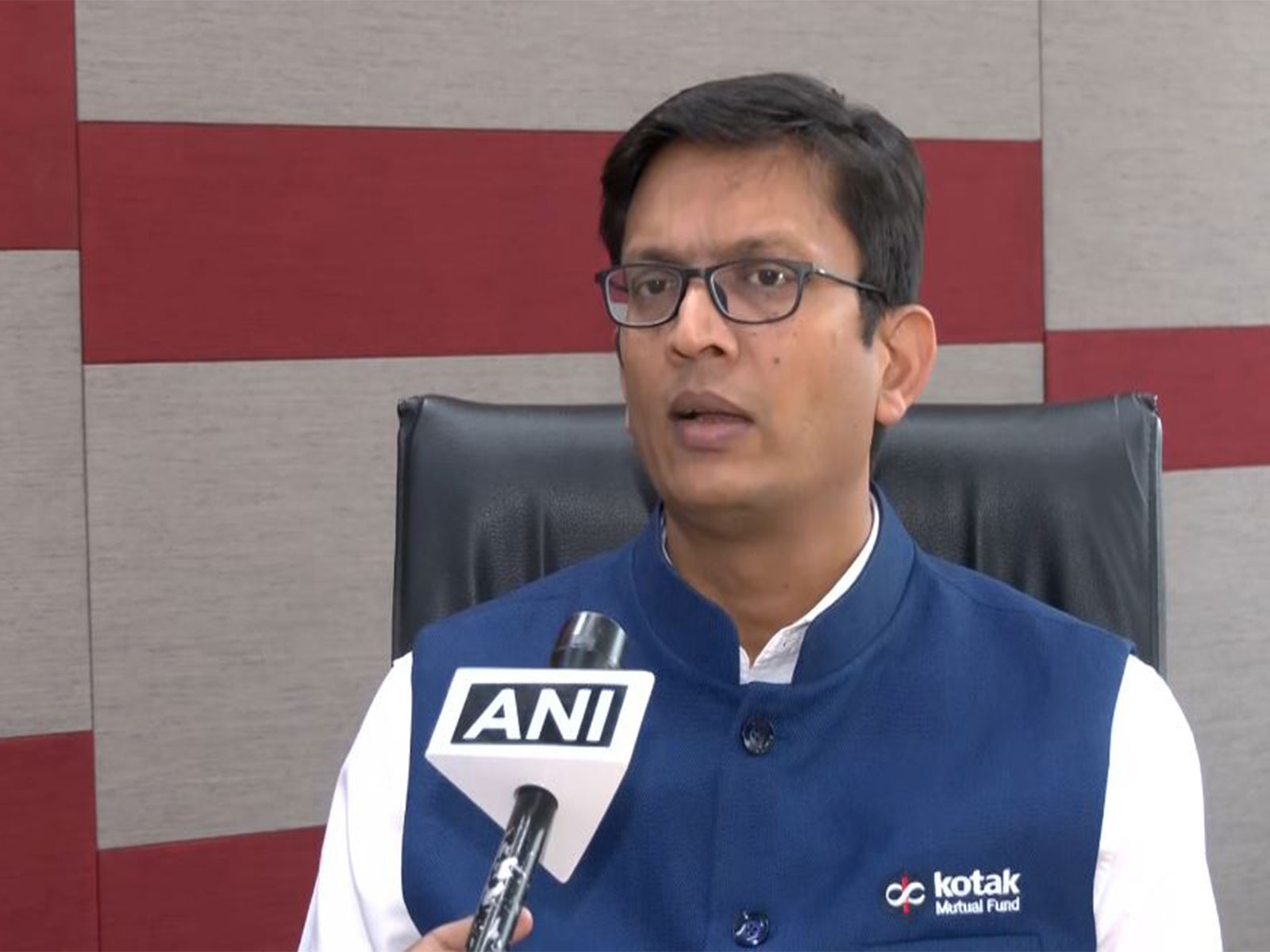

Financial advisory firm Ambit Capital, however, citing a precedent, argues that there is a silver bullet that could somewhat minimize the net impact to companies from prospective dues.

The financial advisory firm says that the Union Government can lower the royalty rate on mining to compensate companies

"And there's a good precedent to it. When India Cement judgement took away state's power to levy tax, Union Government raised royalty rates multi-fold in 1991 in order to compensate states for the losses. And that's why we have the royalty rates where they are today," Ambit Capital said.

In case states start levying taxes retrospectively, Ambit Capital said there is no need for royalties at current rate.

"The Union Government can easily lower these rates. That doesn't even require Parliament approval."

"Interestingly, since WB (West Bengal) has been collecting mining tax all these years, it's the only state that is deprived of enhanced royalty rate that was allowed in 1991. That's as clear a precedent as one needs. Therefore, net impact to companies from prospective dues would most likely be minimal," Ambit Capital said.

On August 14, the Supreme Court ruled that mineral-rich states can collect past dues on royalty and taxes on mines and mineral-bearing land from April 1, 2005, from both the Centre and mining lease holders.

A nine-judge Constitution bench has directed that the past dues be paid in a staggered manner over the next 12 years, starting from April 1, 2026.

On Monday, Fitch Ratings said operating costs of Indian mining companies are likely to rise significantly if states impose additional mining taxes, as allowed by the Supreme Court in the recent judgment.

At the same time, Fitch expects limited financial impact on mining companies as the payment of past dues are to be paid in a staggered manner in a long time frame of 12 years.

S&P Global Ratings had earlier asserted that a shift in the tax landscape for mining companies would have a pass-on effect on steel and other industries, and ultimately on the Indian consumer.