COP28 is turning point in climate action: Group Chief Sustainability Officer FAB

Dec 08, 2023

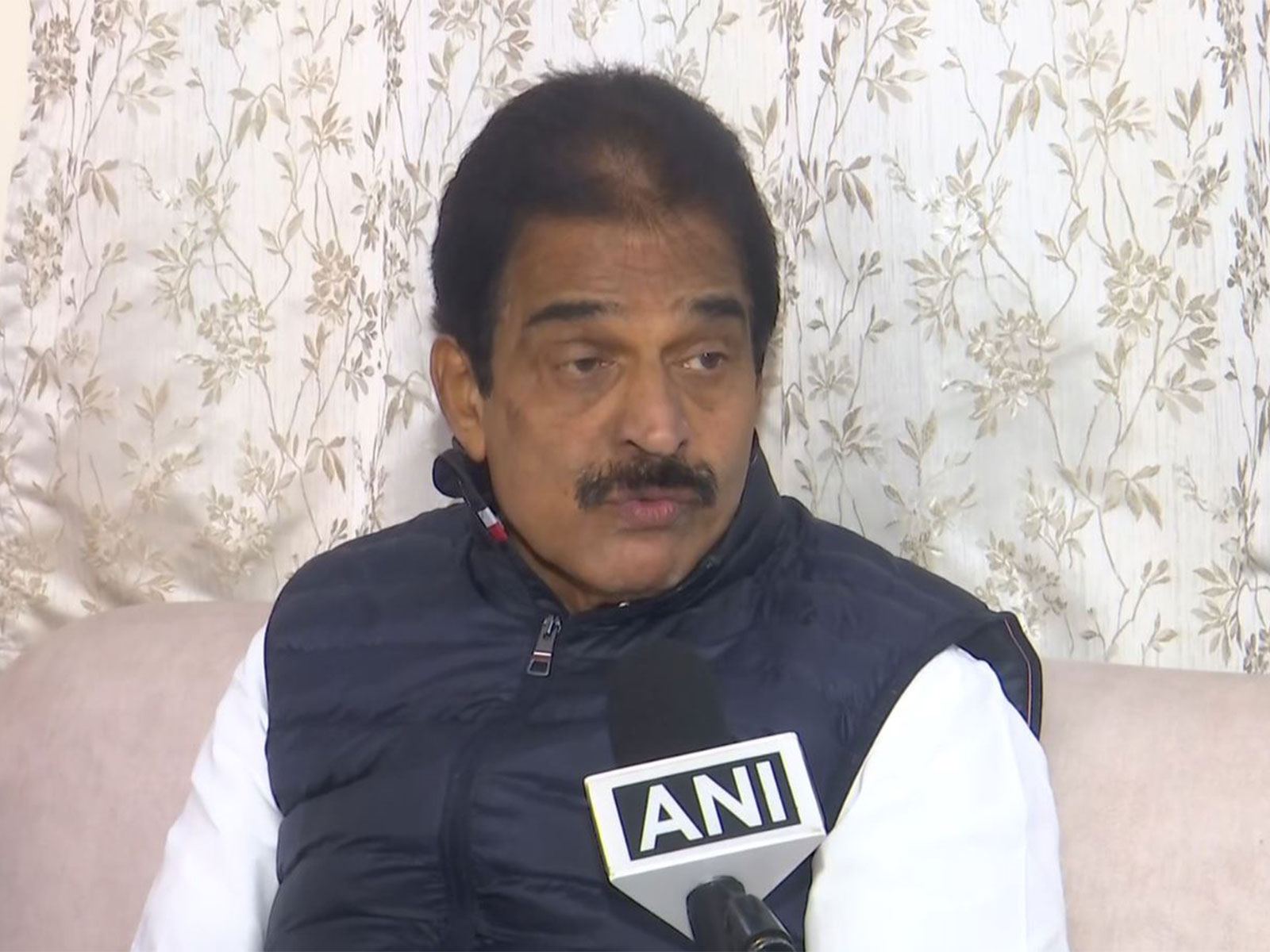

Dubai [UAE], December 8 (ANI/WAM): Shargiil Bashir, Group Chief Sustainability Officer at First Abu Dhabi Bank (FAB), sees COP28 as a turning point in climate action. He highlighted the bank's strong commitment to sustainability by providing green and sustainable financing worth $18 billion during the first nine months of this year, in line with its previous goal of providing financing worth USD 75 billion between 2022 and 2032.

In statements to the Emirates News Agency (WAM) on the sidelines of the COP28 meetings, Bashir said that the bank announced during the conference that it would increase its green financing to USD 135 billion by 2030, an increase of 80 per cent compared to the financing facilities that the bank allocated in 2021.

He added that this step confirms FAB's commitment to playing a leading and effective role in giving more momentum to the sustainable finance agenda in the region to include transition finance projects and early-stage climate change financing, and confirms its flexibility in responding to changes in customer priorities and society in general.

Bashir pointed out that FAB will continue to work on several important areas, including transition finance and green finance, in conjunction with reducing the carbon emissions resulting from the bank's activities, as the importance of climate finance grows to support actions to address climate change.

He said that COP28 provides an important platform to discuss the challenges facing the world in the field of climate change and try to reach solutions that contribute to addressing these challenges, as well as being an exceptional opportunity to shed light on the achievements and efforts made by the United Arab Emirates in order to build a greener future for everyone.

He stressed that FAB always confirms its full support for the state's vision aimed at building bridges of constructive dialogue that lead to tangible positive results in all fields, adding: "We are confident that the United Arab Emirates will be able to successfully implement its ambitious agenda and that COP28 will be a historic turning point in the field of climate action."

Bashir said that the bank's participation in COP28 as a strategic partner represents a strong boost to the UAE's vision of building a sustainable future. It also aligns with the bank's own developmental strategy, which emphasises the importance of sustainability.

He noted that FAB has successfully established itself as a leader in sustainability in the region, and that it is committed to playing a vital role in addressing climate change. The bank has prepared a series of events and activities for COP28, including panel discussions, meetings, and workshops with clients.

FAB's participation in COP28 comes on the heels of several significant sustainability achievements for the bank. It was the first bank in the UAE to commit to net-zero emissions, and it was the first bank in the GCC to join the UN's Net-Zero Banking Alliance.

FAB's COP28 programme focuses on six key areas: Accelerating sustainable finance and advancing the UAE's development as a green finance hub, supporting its clients and partners with the transition to net zero, growing environmental, social, and governance (ESG) awareness and adoption among SMEs, advancing effective carbon markets through production innovation and knowledge transfer, advocating for the restoration of natural ecosystems and biodiversity, and empowering individuals from classroom to boardroom to be change agents for positive environmental action.

FAB was the first bank in the world to join the COP28 Net-Zero Transition Charter, which was launched by the COP28 Presidency. The bank is committed to engaging with stakeholders and continuing to work on climate action.

FAB is also working to contribute to the UAE's national climate goals. The bank's activities include working with the private sector and collaborating with the largest companies in the country, as well as SMEs, to help them take advantage of the opportunities presented by the transition to a net-zero emissions model.

Bashir said that FAB will continue to play a supportive role in the UAE Net Zero 2050 strategic initiative, ensuring that sustainable development pathways are available in all economic sectors. This will support the UAE's efforts to transform current challenges into promising future opportunities, and consolidate the country's leading position in the global climate action arena.

He said that FAB has taken several major steps in recent years that have cemented its regional leadership in the sustainable finance sector. In 2017, the bank issued the first green bond in the region. It has also continued to work with clients to help them transition to net-zero emissions, including by understanding the diverse needs of private sector companies and developing tailored solutions for them at all levels.

"Our efforts reflect the vital role that banks play in supporting the real economic transition to net-zero emissions, and contribute to setting standards that the sector as a whole can follow. We have made significant progress in strategic financing by providing financing for sustainable projects in the energy, buildings, transportation, waste, water, and food sectors," Bashir said.

Bashir also stressed that FAB's initiatives will help to boost cooperation in the region, support more sustainable projects, and engage with a wider range of clients in the transition phase, while also contributing to the UAE's position as a major hub for green finance.

In response to a question about the bank's most notable positive results from its sustainable finance activities, Bashir said, "We have made significant progress in supporting a select group of the largest and most well-known institutions and entities in the UAE to achieve significant leaps forward in their climate goals. In 2022, FAB played a leading role as the green financing coordinator, structuring agent, bookrunner, and mandated lead arranger alongside another bank in Masdar's deal for the Zarafshan project, the first wind farm in the utilities sector in Uzbekistan."

Bashir added, "In addition, many of the other projects we have financed have had a positive sustainable impact, including three solar projects that help to reduce 1,989,000 tons of carbon dioxide emissions each year, seven green buildings we financed that received a 2-Pearl rating under the Pearl Rating System- Estidama, and financing for a wastewater treatment plant that treats 430,000 cubic meters of water per day." (ANI/WAM)