COVID-19 impact on trade: India-Singapore businesses find a way forward

Aug 17, 2020

By Lee Kah Whye

Singapore, August 17 : Last week, Singapore reported that its merchandise trade declined by 15.2 per cent in the second quarter of 2020 compared with a year ago. This follows a 0.5 per cent growth in the first quarter.

This was revealed in a review of 2Q 2020 trade performance by Enterprise Singapore in a media release.

Enterprise Singapore is a government agency under the Ministry of Trade and Industry, which supports the growth of Singapore as a hub for global trading and startups. It works with companies to build capabilities, innovate, and internationalise.

In Q2, both oil and non-oil trade weaken. Oil trade contracted by 61.9 per cent in 2Q 2020 amid lower oil prices when compared with a year ago, following a 15.9 per cent decrease in the previous quarter. Non-oil trade fell 3.3 per cent in 2Q 2020 after the previous quarter's 4.4 percent rise.

However, non-oil domestic exports (NODX) grew by 6.5 per cent in 2Q 2020 albeit from a low base from a year ago. In 1Q 2020, NODX expanded 5.4 per cent. Both electronic and non-electronic NODX grew in 2Q 2020. The main sectors that contributed to the increase are non-monetary gold and pharmaceuticals. Non-oil re-exports (NORX) declined by 6.6 per cent.

Although global outlook remains uncertain, the trade agency now expects that trade growth is less likely to reach the worst-case scenario project earlier. In May, it had forecasted that total trade and NODX would be between "-12.0 to -9.0 per cent" and "-4.0 to -1.0 per cent" respectively amid the COVID-19 outbreak. Both the global economy and trade volumes were then projected to decline in 2020.

However, following the finalisation of the 2Q 2020 numbers, it has adjusted total merchandise trade and NODX forecasts for 2020 upwards to "-10.0 to -8.0 per cent" and "3.0 to 5.0 per cent" respectively. This is due to better than expected performance for specific products like non-monetary gold, pharmaceuticals and electronics.

Furthermore, the World Trade Organisation (WTO) has affirmed that world merchandise trade volumes are now unlikely to reach the worst-case scenario of a 32 per cent contraction projected back in April 2020.

In line with general trade contraction, Singapore's trade with India for the first 6 months of this year also declined. Based on data from Department of Statistic Singapore, total merchandise trade between Singapore and India declined 16.2 per cent to SGD 9.1 billion (USD 6.64 billion) when compared with the same period last year.

The main goods that are bought and sold between the two countries are oil and petroleum products, organic chemicals, machinery, electrical and electronic products, plastics and pearls, precious stones and metals.

It should however be noted that merchandise trade between Singapore and India has been slowly declining over the years. However, trade in services has been on the ascendency. Total services trade between the two countries grew 33.6 per cent from SGD 8.1 billion to SGD 12.2 billion (USD 8.9 billion) between 2014 to 2018. Transportation, financial services and business management leadthe services trade between the two countries.

Singapore's total services trade contracted 22.2 per cent to reach SGD 107.0 billion (USD 87.1 billion) in 2Q 2020.

To promote trade and take advantage of business opportunities between Singapore and India, there have been various business exchanges organised by industry organisations of both countries. This is to ensure trade continues to grow now and in the post-COVID era.

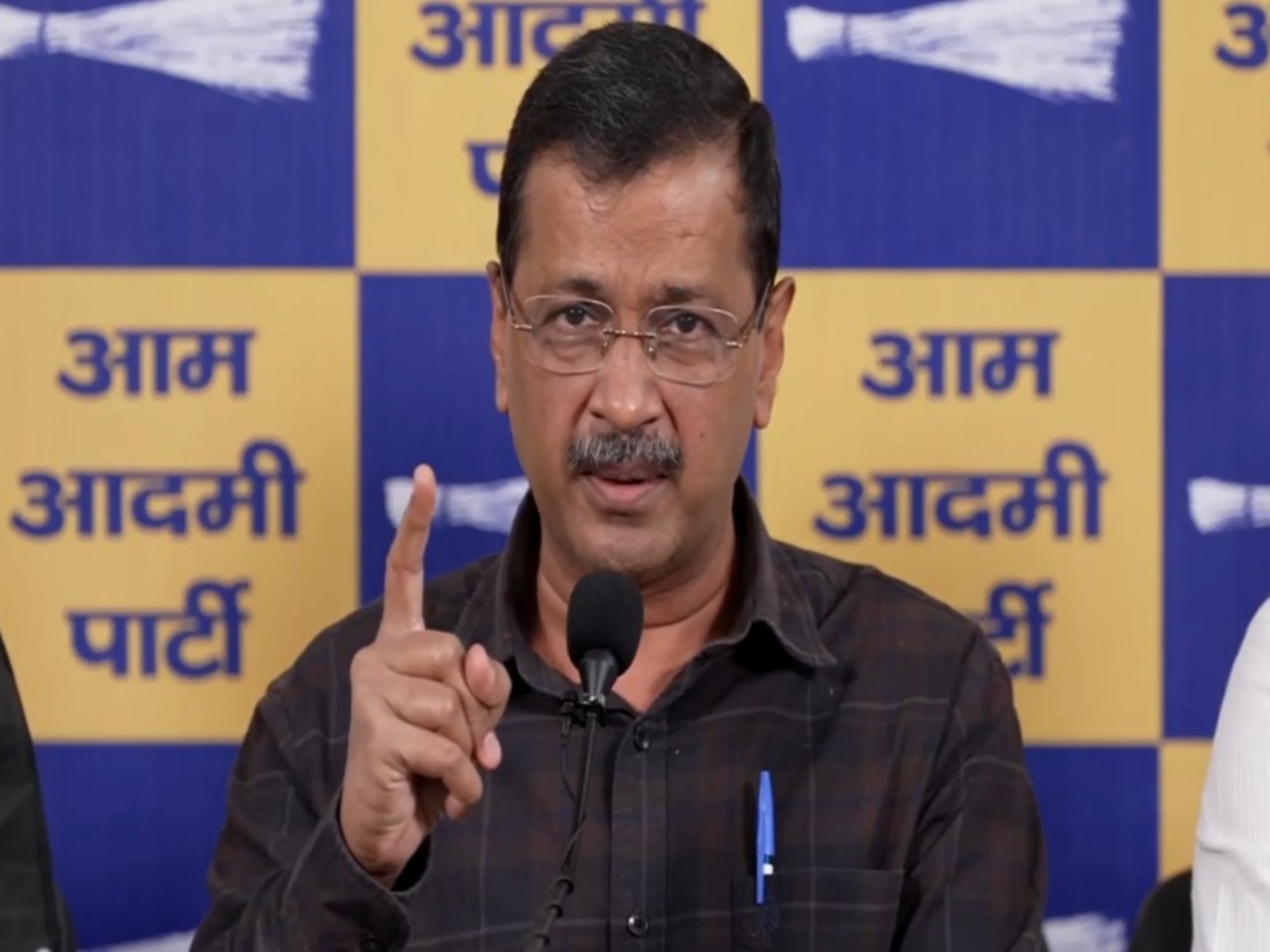

In a recent webinar organised by the International Business Division (IBD) of the Singapore Indian Chamber of Commerce and Industry (SICCI), Indian business leaders promoted business opportunities in the state of Uttar Pradesh. They suggested Singaporean SMEs can take advantage of these opportunities when considering overseas expansion.

In a report by The Business Times of Singapore, Gautam Banerjee, chairman of the South Asia business group of the Singapore Business Federation, noted that Uttar Pradesh, with a population larger than that of Brazil, offers opportunities for the automotive industry, manufacturing and agriculture. Banerjee is also chairman of Blackstone Singapore.

Singapore continues to be the largest source of foreign domestic investment in India. However, investors are generally less familiar with Uttar Pradesh compared to the better-known regions such as Tamil Nadu.

Mukherjee added that Singapore's expertise in tertiary and vocational education can be exported to India, which has one of the largest populations of young people among major global economies.

Enterprise Singapore together with Invest India have hosted a number of events to promote collaboration in food processing, agri-sourcing, automotive and electric vehicles. Other opportunities for collaboration lie in India's startup scene and ecosystem.

Last year, Enterprise Singapore launched a Global Innovation Alliance with India in order to promote a two-way flow of startups and ecosystem players.

"Through this initiative, several virtual missions have been led, where Singapore startups were exposed to the rich startup ecosystem in India," said Tay Lian Chew, global markets director for SEA at Enterprise Singapore. "We will be keen to work with startups and ecosystem players in Uttar Pradesh to explore similar collaborations."

IBD Chairman Prasoon Mukherjee said the organisation has been working closely with the SME community in Singapore in order to help them better understand the grants and financial aid available to them during this crisis while continuing to encourage them to explore markets like India.

"We want the SMEs not to lose sight of the need to build resilience and lay the foundation for growth in the coming years," the IBD Chairman said.