Data available shows tax collection at source mechanism has been abused, volumes fairly substantial: CEA

May 25, 2023

By Shailesh Yadav

New Delhi [India], May 25 : Chief Economic Advisor V Anantha Nageswaran on Thursday said that data available on usage of international credit cards points out that tax collection at source mechanism has been "abused" and these "volumes involved were fairly substantial".

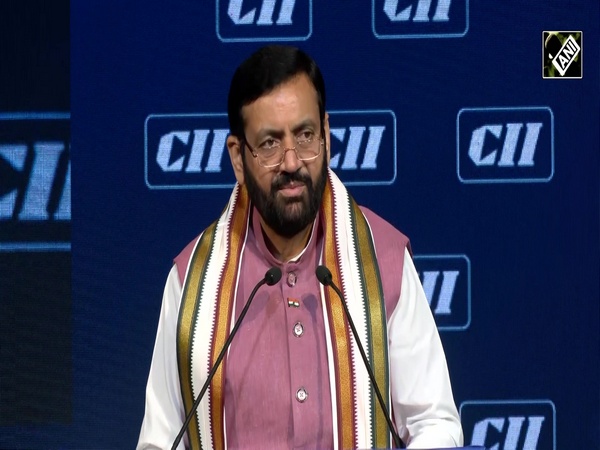

The Chief Economic Advisor was addressing the 'Building a Robust Financial Sector for a Competitive Economy' session at the CII Annual Session 2023 here on Thursday.

"There are data that are available with the government that do point out that this mechanism has been not just abused by a small set of people or by those who are evading taxes but the volumes involved are fairly substantial," V Anantha Nageswaran said

The CEA said he does not see any impact on ordinary taxpayers under the new mechanism of tax collection at source (TCS) rules with exemptions.

The Ministry of Finance has recently announced some changes in the TCS rules for international transactions made using debit or credit cards.

Starting from July 1, 2023, individuals conducting international transactions up to Rs 7 lakh will be exempt from the 20 per cent TCS levy. This exemption will also exclude these transactions from the Liberalised Remittance Scheme (LRS) limits of USD 250,000 per annum.

"With the Rs 7-lakh exemption, the bulk of the transactions made by most of us will be outside the levy (TCS). TCS payments will also lead to lower TDS, there will be a pass-through," Nageswaran said.

Responding to a question over privatisation, Nageswaran said there will be "some ebb in the flow including the process which is time-consuming."

Sharing his views on the role of the financial sector towards a more competitive economy, Nageswaran highlighted three important aspects.

He said that energy is the single-most important driver of the economy and energy security is coming under pressure. He emphasised that banks should not only focus on climate mitigation but should also fund climate adaptation.

Nageswaran stressed on the importance of continued funding to the fossil fuels sector, even as "we move towards a better balance of renewables in the energy mix".

This, he said, was necessary to not jeopardise growth. He further advised that financial institutions should look at overall environmental costs while evaluating green projects.