Finance Minister Sitharaman launches ARCL and CDMDF for Corporate Bonds

Jul 28, 2023

Mumbai (Maharashtra) [India], July 28 : Finance Minister Nirmala Sitharaman launched two landmark institutions, AMC Repo Clearing Limited (ARCL) and Corporate Debt Market Development Fund (CDMD) organised by the Securities and Exchange Board of India (SEBI).

Ajay Seth, Secretary, of the Department of Economic Affairs, Ministry of Finance and Madhabi Puri Buch, Chairperson of SEBI shared the stage with Finance Minister.

Nirmala Sitharaman said, “in the economy, it is the financial sector which becomes a very effective barometer of the underline confidence in the macro economy fundamentals of any country and it also reveals the growth potential that exists.”

“We have carried out manifold reforms in the financial sector & have innovatively used technology to achieve financial inclusion at scale, fostering transparency. India has leveraged technology to its fullest in every segment of the financial ecosystem”, said Finance Minister.

Under the Stock Exchanges and Clearing Corporations (SECC) Regulations, 2018, AMC Repo Clearing Limited (ARCL), which was established in April 2021, has received in-principle approval from the Securities and Exchange Board of India (SEBI).

ARCL is a Central Counter Party (CCP) that provides clearing and settlement services to all trades made in corporate debt securities on the NSE and BSE.

Sitharaman said, “Quality, proportionality & effectiveness of regulations matter the most for ease of doing business, ease of investing & ease of living”.

This Board Memorandum proposes to make it easier to establish Corporate Debt Market Development Fund ("CDMDF" or "the Fund") as an Alternative Investment Fund (AIF) under the SEBI (Alternative Investment Funds) Regulations, 2012 (hereinafter referred to as "AIF Regulations").

The Fund will act as a Backstop Facility for the purchase of investment-grade corporate debt securities to instil confidence among participants in the Corporate Bond Market during times of stress and uncertainty.

At the time of launch, Finance Minister stated that “the regulatory environment must strive to balance, at all times, the creation of a conducive environment for starting and running businesses, maintenance of market integrity, and sustenance of market stability.”

“The possible trinity by which we advance the financial domain – with markets, regulators, the government, policymakers, & legislators all looking forward to a robust market system that will guide us towards a developed India”, said Finance Minister Nirmala Sitharaman.

Nirmala Sitharaman said, “it’s a matter of pride that Indian financial market ecosystem ranks among the best in the world in terms of the technology and value/volume aspects of trading”.

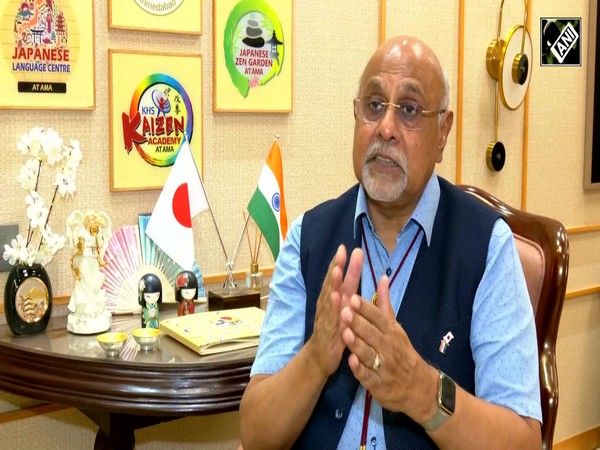

While introducing the event, Madhabi Puri Buch, SEBI chairperson said, “it is this leadership that has inspired so many of us to collaborate, to come together in the creation of CSMDF, equally the creation of the limited purpose clearing corporation has also been inspired by the government's commitment to the development of the bond market.”

"This is a robust growth that we are experiencing today”, said the Finance Minister.