Foreign investors taking money off table amid volatility, high valuation fears in India

Aug 13, 2024

New Delhi [India], August 13 : Foreign portfolio investors are taking money off the table lately, amidst volatility in the Indian stocks. Over the past two months, June and July, they were net buyers and have somewhat helped the stock indices to soar to multiple all-time highs.

But so far in August, FPIs have sold Rs 17,404 crore worth of Indian stocks, National Securities Depository Limited data showed.

Analysts attribute fears that the US economy might slow as reflected in the recent unemployment data, coupled with hints that Indian stocks are possibly highly valued as the reason behind the latest FPI sell-off.

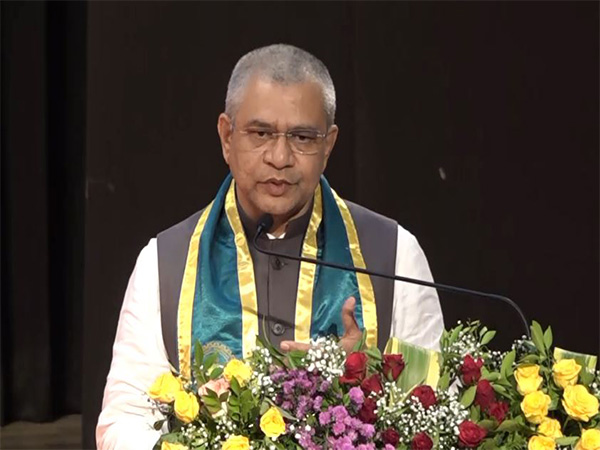

"Indian stock valuations continue to remain elevated, particularly in relation to valuations in other markets," said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

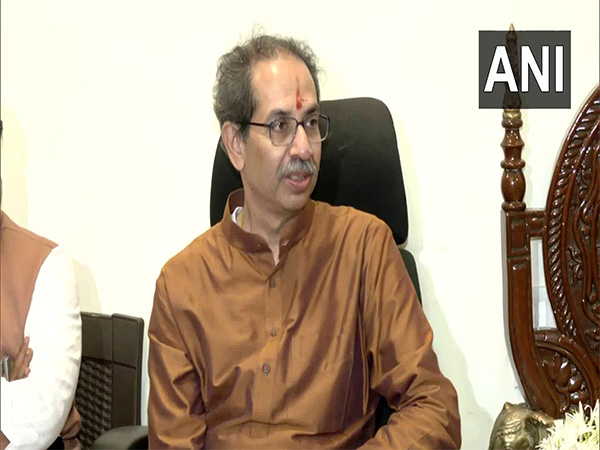

"India's strong economic growth, coupled with its political stability and ongoing structural reforms, makes it an attractive destination for global investors. Moreover, the increasing integration of India into global supply chains and its strategic initiatives in digital transformation and infrastructure development are likely to draw sustained foreign investments. While short-term volatility in FII flows is expected, the long-term outlook remains positive," said Alok Agarwal, Head - Quant and Fund Manager, Alchemy Capital Management.

The buying spree in Indian stock markets by foreign portfolio investors (FPIs) continued into the second month through July. The net foreign investments into the Indian stock market stood at Rs 32,365 crore last month. In June, they bought stocks in India worth Rs 26,565 crore on a cumulative basis.

Foreign buyers investing in Indian stocks, at a time when both domestic institutional and retail investors, led indices Sensex and Nifty to touch fresh record highs now and then. Nifty for the first time recently touched the milestone of 25,000 mark.

The index has gained substantially over the past three months, driven by robust GDP growth, controlled inflation, strong domestic liquidity, and favorable monsoon conditions.

FPI activity in June and July was influenced by the election results, as the formation of the new government happened smoothly.

As per definition, Foreign Portfolio Investment (FPI) involves an investor buying foreign financial assets.

In the two months preceding June and July, the foreign portfolio investors were net sellers in India, data showed. Interestingly, at a time when overseas investors were net sellers in Indian equities, domestic institutional investors stayed net buyers, largely making up for the outflows by foreign investors.