"Fund cited by Hindenburg not domiciled in Mauritius" says Mauritian banking regulator, objects to 'Tax Haven' label

Aug 14, 2024

New Delhi [India], August 14 : The Financial Services Commission, Mauritius on Tuesday issued a statement on the latest allegations cited in the US Short seller Hindenburg research report. In its statement the Mauritian regulator said that Mauritius does not permit creation of shell companies and cannot be described as a 'Tax Haven' as has been done by Hindenburg.

The FSC is the integrated regulator for the non-banking financial services sector and global business.

"FSC has taken cognizance of the contents of the report published by Hindenburg Research on 10 August 2024 wherein mention has been made of 'Mauritius-based shell entities and Mauritius as a 'tax haven'. The FSC wishes to highlight that the legislative framework in Mauritius does not permit creation of shell companies. Mauritius has a robust framework for global business companies," a statement from FSC Mauritius read.

"All global business companies licensed by the FSC have to meet substance requirements on an ongoing basis as per section 71 of the Financial Services Act which is strictly monitored by the FSC. Moreover, the FSC wishes to highlight that Mauritius strictly complies with international best practices and has been rated as compliant with the standards of the Organisation for Economic Co-operation and Development ("OECD")," the statement added.

The Mauritian regulator also clarified that the fund 'IPE Plus' cited by the US short seller is not a licensee of the FSC Mauritius.

"The report of Hindenburg has further cited '"IPE Plus Fund" Is A Small Offshore Mauritius Fund' and 'IPE Plus Fund 1, a fund registered in Mauritius'. We wish to clarify that IPE Plus Fund and IPE Plus Fund 1 are not licensees of the FSC and are not domiciled in Mauritius.

In its report, Hindenburg alleged that "In one complex structure, a Vinod Adani-controlled company had invested in the "Global Dynamic Opportunities Fund" ("GDOF") in Bermuda, a British overseas territory and tax haven, which then invested in IPE Plus Fund 1, a fund registered in Mauritius, another tax haven. The current SEBI Chairperson and her husband, Dhaval Buch, had hidden stakes in the exact same obscure offshore Bermuda and Mauritius funds, found in the same complex nested structure, used by Vinod Adani."

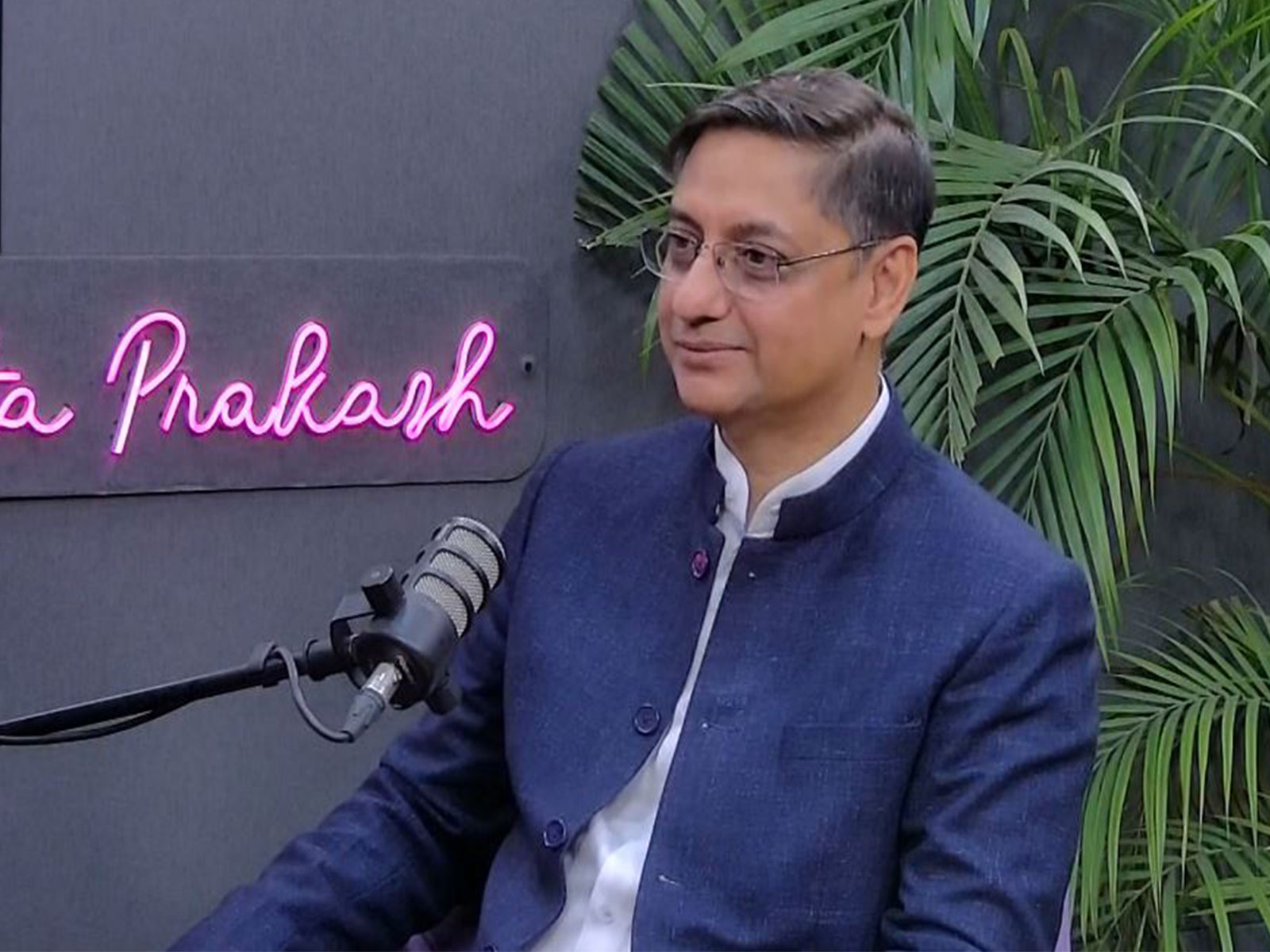

In a joint statement, SEBI chairperson Madhabi Buch and her husband had said, "The investment in the fund referred to in the Hindenburg report was made in 2015 when they were both private citizens living in Singapore and almost 2 years before Madhabi joined SEBI, even as a Whole Time Member. "

Meanwhile, on Tuesday Global index provider Morgan Stanley Capital International (MSCI) announced the removal of the freeze on Adani Group stocks, a move that comes amid ongoing scrutiny following the Hindenburg Research allegations. Starting with the August 2024 Index Review, MSCI will implement changes. The adjustments will include updates to the Number of Shares (NOS), Foreign Inclusion Factor (FIF), and Domestic Inclusion Factor (DIF) for Adani Group and associated securities.