How to secure your future with high special FD rates from Bajaj Finance

Nov 04, 2022

Pune (Maharashtra) [India], November 4 (ANI/NewsVoir): In response to the 50-basis point hike in the repo rate recently, issuers are now offering higher FD rates. This makes for a great opportunity for investors like you to secure your future. After all, FD rates have a direct correlation with the earnings you accumulate during the investment tenure. High FD rates mean you get a larger payout at the time of maturity, and you can forecast the increase in your earnings with ease using an FD calculator.

Handsome returns are not the only way fixed deposits help you secure your financial well-being. Given that an FD is a low-risk instrument, it diversifies your portfolio. This helps adjust the risk levels of your overall investments and assures stable earnings.

Today, there are myriad options available to you to choose from and start growing your wealth. Among these is the Bajaj Finance

with FD rates going up to 7.75 per cent annually. To know more about how you can secure your future with a Bajaj Finance Fixed Deposit, read on.

Flexible investment tenure to capitalise on the high FD rates

While increasing FD rates impact your earnings, so does your investment tenure. A lengthy tenure for your fixed deposit means that you invest for a longer time to enjoy the power of compounding returns. Here, your interest payout is added to your total corpus, allowing you to earn more. Additionally, issuers like Bajaj Finance offer higher FD rates on longer tenures.

You can invest in a Bajaj Finance Fixed Deposit anywhere from 1 to 5 years. The FD rates that you enjoy depend on the maturity timeline you choose and vary accordingly. This means you earn more when you book an FD for 22 months as compared to 12 months, and so on. By choosing the longest tenure that aligns with your goals - be it a vacation, an educational need, or the purchase of an asset - you can benefit from high FD rates and grow your wealth easily.

Moreover, you get even higher FD rates as a senior citizen. Bajaj Finance offers seniors a rate benefit of 0.25 per cent p.a. To forecast your returns based on the investment period and customer profile, simply use the online

on the Bajaj Finance website or app.

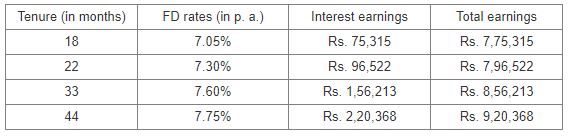

Given below are tables that depict your returns on an investment of Rs 7 lakh for varying tenures.

FD returns for a senior citizen investor

FD returns for an investor below 60 years of age

Availability of an emergency loan during a shortfall

Generally, you may think of making a premature withdrawal from your fixed deposit during an emergency cash crunch. While this may help you meet your needs, it can put your future at risk. You not only lose the earnings applicable to the withdrawn amount but also need to pay a penalty. Instead, can avail of a loan against your Bajaj Finance FD.

If it is a cumulative deposit, you can get up to 60 per cent of the FD value as a loan. In the case of non-cumulative deposits, this figure can go up to 75 per cent of the FD value. This way you can meet your needs without paying a penalty or losing out on the returns from high FD rates.

Assured security and safety with the highest ratings from CRISIL and ICRA

The Bajaj Finance Fixed Deposit comes with the highest safety ratings, CRISIL AAA/STABLE and [ICRA]AAA(Stable). This feature is especially important in a volatile economy where market fluctuations can lead to the loss of your capital. With the Bajaj Finance Fixed Deposit, however, you can invest securely and receive your payout and the initial investment on time.

Systematic Deposit Plan for consistent and convenient investments

The Bajaj Finance Fixed Deposit also comes with an SDP plan where you make monthly FD investments starting at just Rs. 5,000. This allows you to begin the journey of growing your wealth even if you do not have significant savings. The process of opting for an SDP is as simple as investing in a regular fixed deposit. The FD rates applicable here are based on the current market rates each month. With proper planning using the FD calculator, you can get the returns to enjoy financial stability in your future with SDPs.

With all these benefits of the Bajaj Finance FD, you can secure tomorrow while keeping today in mind! Enjoy an online investment process that is simple, quick, and easy and do not forget to use the FD calculator to plan your investment.

today to grow your wealth with high FD rates.

This story has been provided by NewsVoir. ANI will not be responsible in any way for the content in this article. (ANI/NewsVoir)