Indian economy is resilient, not going to be impacted by OPEC+ oil output cut: Economist

Oct 06, 2022

By Ayushi Agarwal

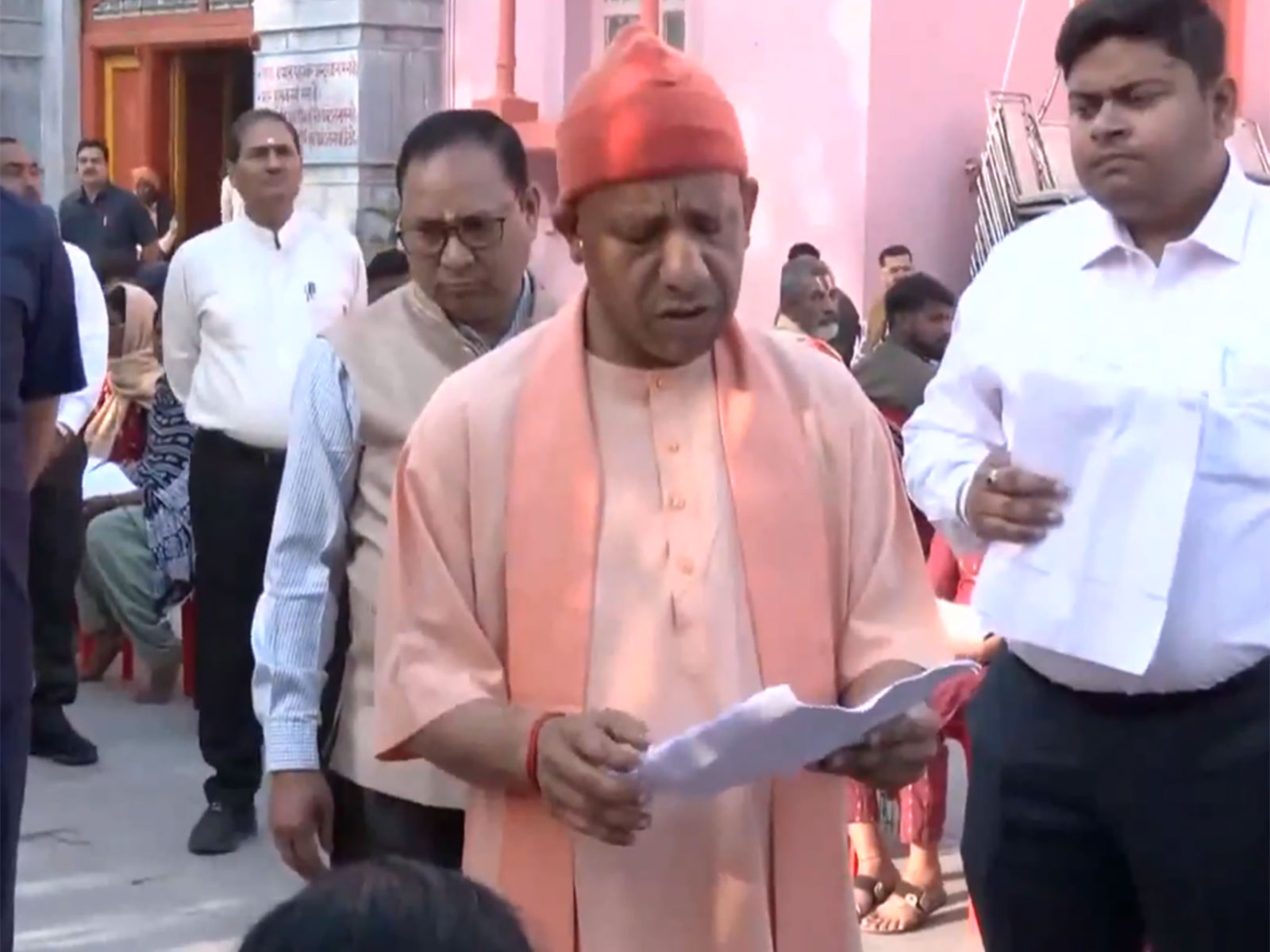

New Delhi [India], October 6 : After OPEC+ agreed to steep oil production cuts on Wednesday, curbing supply in an already tight market, Indian economist Dr Charan Singh called India 'fortunate' enough as the country is not going to be badly impacted by these policies as it is not on the verge of recession.

The economist also stressed the fact that India may get impacted because of the overall price but can insulate itself as far as the bigger picture is concerned.

"As far as India is concerned the situation obviously has to be optimally utilized. India is fortunate that we have oil in our own country. We also have friendly relations with Russia. We have been very lucky to strike a Russian Ruble agreement under which we will not be impacted by the exchange rate movements," Dr Charan Singh told ANI.

"I think India needs to capitalize on that as far as oil prices are concerned. India may get impacted because of the overall price rise which will happen due to the price cut. But I think we can insulate ourselves as far as the bigger picture is concerned", he added.

While issuing a piece of caution, Singh said that India cannot insulate itself completely if the exports are not absorbed in the West, especially if the world is in a state of recession.

"We either need to look for alternate sources or change our production style and look for a domestic market that will involve some disruption and some change to that extent. India will have to step in. But the good news is that all experts including at the IMF and the World Bank, and even the private parties like Bloomberg, all agree that India is not on the verge of a recession. India may have a little slow down here but India has emerged as a very resilient economy and therefore India is not too worried or is not going to be badly impacted by these policy decisions of open and use", he said.

On Wednesday, OPEC+ agreed on steep oil production cuts causing one of its biggest clashes with the West as the US administration called the surprise decision shortsighted.

Further highlighting the fact that the Americans called the decision 'shortsighted', the Indian Economists said that they are catering to their local constituency because they have elections coming up.

"The Americans have said that it's shortsighted because they have their midterm election coming up. They're catering to their local constituency. Saudi Arabia and OPEC countries are also taking care of their own local constituency. I interacted when I was at the IMF in Washington with some of these members and representatives from OPEC countries. They were very clear in their mind, they told me that the oil which is under the soil, belongs to the future generations and is the result of the past generations. Therefore they need to get the best price that they can fetch. Otherwise, they are answerable to the Future generations and the past Generations", said the economist.

"The global economy is in a recessionary phase and slowing down. If the demand for oil goes down, it is again natural that the price of oil will go down. As far as the world economy is concerned, there has been a knee-jerk reaction. As an economist I can see for the last many years, the subprime crisis came because subprime lending had taken place, the expansion of the balance sheets that took place in America. Ain't it expected that this will all lead to Inflation? And that's exactly what has happened. Covid made the situation critical. The Russia - Ukraine war was a trigger, but one day this had to happen, Singh added.

While speaking to ANI, Dr Charan Singh said that the FED Reserve increased four times from 2008 to 2012 and then doubled within two years.

"OPEC has its own reasons and they are saying that the interest rate cycle which has started in the US for the fallacy of policy which started under the subprime should open countries. So, there are pros and cons on both sides", he said.

Earlier in a statement, the White House stated, Biden was "disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin's invasion of Ukraine."

The statement added that Biden had directed the Department of Energy to release another 10 million barrels from the Strategic Petroleum Reserve next month.

"In light of today's action, the Biden administration will also consult with Congress on additional tools and authorities to reduce OPEC's control over energy prices," the White House statement read.