LIC Housing Finance Implements Pennant's Lending Platform for Driving Business Agility and Superior Customer Experiences

Feb 09, 2024

BusinessWire India

Hyderabad (Telagana) [India], February 9: Pennant Technologies, an agile and innovative financial technology company, today announced LIC Housing Finance Ltd. (LIC HFL), one of the largest housing finance companies in India, has deployed its state-of-the-art lending platform - pennApps Lending Factory - to modernise and transform its mortgage operations with a focus on improving operational efficiencies and delivering enhanced customer experience. As part of the "Project RED (Reimagining Excellence through Digital transformation)" initiative, Pennant helped implement an enterprise-wide lending platform that will harvest the power of its technology to drive business agility, deliver seamless customer experiences and lay the foundation for business growth.

In October 2020, LIC HFL launched the Project RED initiative to transform its operations and improve efficiencies across the organization. Encompassing all its stakeholders including customers, employees, business associates and shareholders, Project RED initiative is expected to focus on adopting world-class technologies, strengthening the company's operational processes and deepening customer engagement for driving value. Boston Consulting Group (BCG) is the consultant to LIC Housing Finance for the Project RED programme.

"LIC Housing Finance is at the cross roads of its next phase of expansion and growth, and Project RED is a catalyst in making this journey a successful one," said Sri Tribhuwan Adhikari, MD & CEO, LIC Housing Finance Ltd. "By implementing a next-generation, technology agnostic and scalable lending platform, we will be well placed to effectively meet the dynamic market needs, evolving digital consumer paradigm, and regulatory and compliance needs and help us deliver enhanced value for our customers."

The new lending platform is based on a unique concept of functional factories and business process driven execution engines that will deliver the required modularity, flexibility and componentisation. The technology agnostic system with future proof architecture will provide LIC HFL high level of configurability to accelerate time to market, enable quick workflow reconfiguration to streamline operations for efficiency, flexibility and transparency, meet internal compliance and risk management needs, and would include a repository of third-party APIs for delivery of differentiated customer experiences.

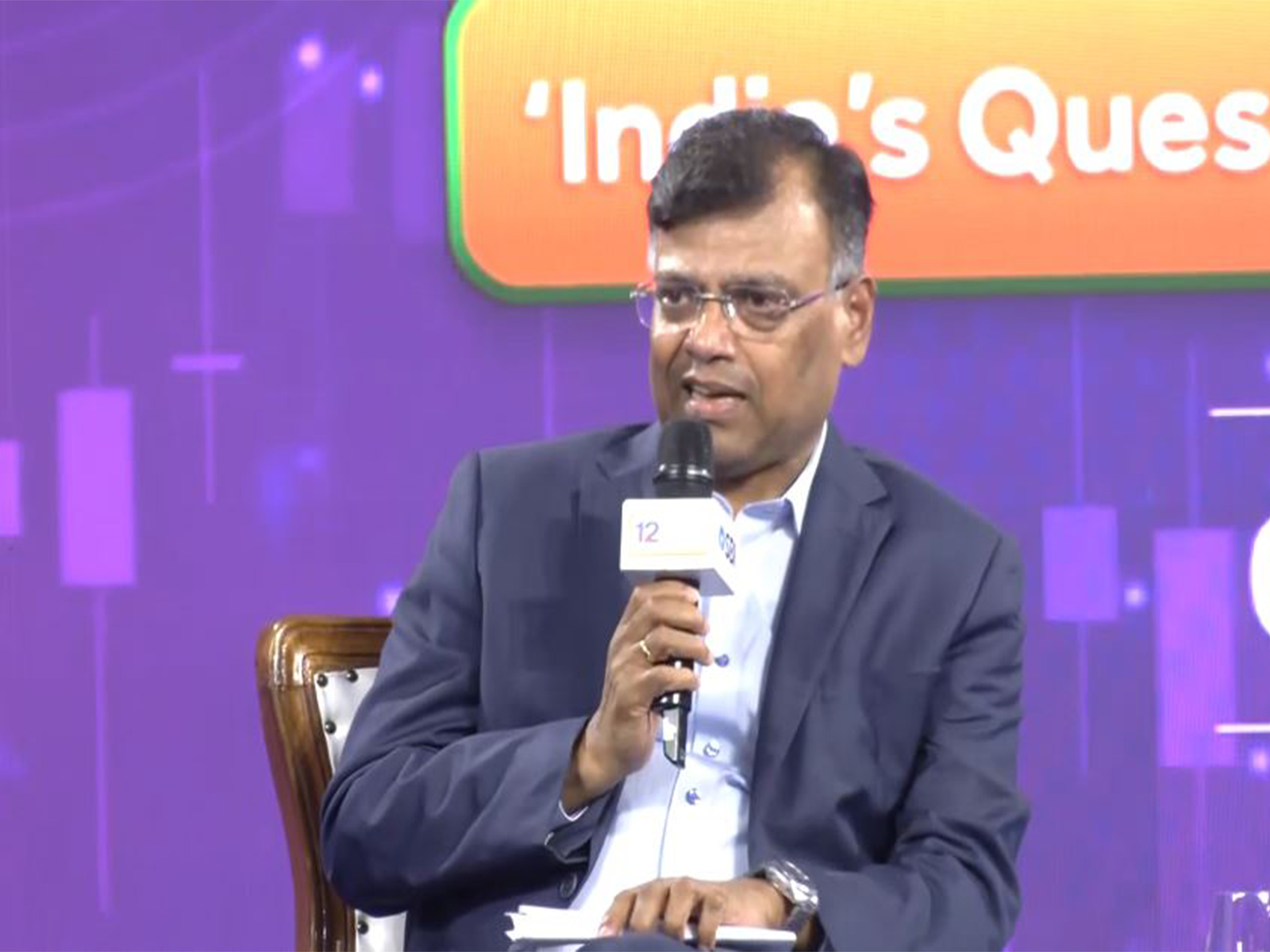

"We are excited at the opportunity to implement an enterprise-wide, future-ready lending platform for LIC Housing Finance," said Rama Krishna Raju, Director and CEO, Pennant Technologies. "We strongly believe pennApps Lending Factory to be a right fit for effectively meeting the diversity, scalability and flexibility needs of LIC HFL's size and scale of mortgage operations. The new lending system will enable LIC HFL to accelerate innovative offerings to the market, improve business performance and help drive future growth."

pennApps Lending Factory is a comprehensive, state-of-the-art lending platform built on Pennant's next generation Application Framework. A novel concept of business process driven execution engines with multitude of functional factories at its disposal allows a bank/financial services company to define, deploy and manage the business processes without any dependency on vendor or internal technology teams.

Pennant's lending platform has won numerous industry awards and recognitions including Asia Fintech Awards, nasscom SME Inspire Awards, Stevie International Business Awards, and as a Finalist at the 12th Aegis Graham Bell Awards (Innovative Digital Transformation for Banking category) among others for its strong functionalities, high product configurability and business process centricity.

For more information on pennApps Lending Factory, visit: http://www.pennanttech.com/lending-factory/

(ADVERTORIAL DISCLAIMER: The above press release has been provided by BusinessWire India. ANI will not be responsible in any way for the content of the same)