Majority of developers seek tax rationalisation and low interest rates from Budget

Jul 05, 2024

New Delhi [India], July 5 : A survey conducted by real estate association CREDAI and investment management company Colliers found that the majority of the real estate developers expect tax rationalization, sops for affordable housing, and single window clearance from Union Budget 2024, slated to be tabled sometime later this month.

Furthermore, as per the survey, developers hoped that GST-related input tax concession and interest rate reduction could provide financial elbowroom to developers and improve the financial viability of real estate projects.

Over the last 2-3 years, the housing market has seen an uptick in demand across the tier I and II cities of the country and developers are optimistic that the momentum is likely to continue in 2024.

As per the Developer Sentiment Survey conducted by CREDAI and Colliers, during April-May 2024, about half of the surveyed developers are confident of buoyant residential demand in 2024.

Amidst strong demand, about 52 per cent of the developers surveyed pan-India expect housing prices to rise in 2024. During 2023, average housing prices across the eight major cities of the country saw a 9 per cent year-on-year rise.

The trend persisted in the first quarter of 2024 with a 10 per cent year-on-year rise and is likely to continue for the rest of the year, albeit at a steady softer pace.

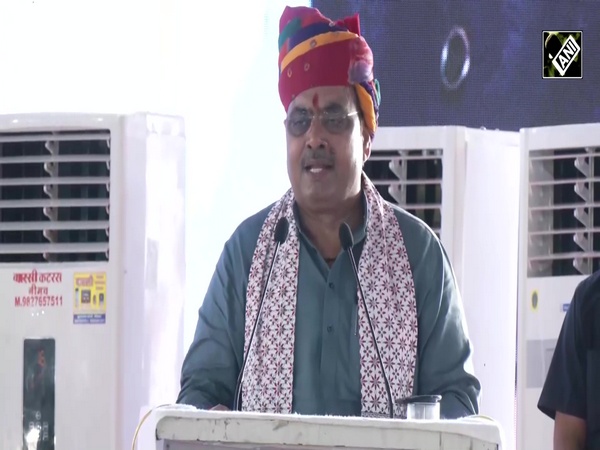

"The survey suggests that the current developer sentiment remains largely positive with more than half of the respondents feeling bullish about the sustenance of the current market dynamics in 2024. However, tackling rising construction costs and rationalization of taxes remain key expectations from the new Government, with more than 50 per cent of Developers seeking constructive solutions for the same," said Boman Irani, President, CREDAI.

The report Real Estate Developers' Sentiment Survey 2024 presented developers' assessment regarding the performance of the residential segment in 2023 and the likely trajectory of the housing market in 2024. Responses from over 550 respondents from 18 states across India were compiled and analysed.

Here are some of the key survey results:

53 per cent of the developers feel that buyer enquiries and engagement increased in 2023 compared to 2022.

45 per cent of the developers saw a 10-20 per cent rise in construction costs in 2023 amidst rising input costs.

About half of the developers feel that residential demand would remain stable in 2024, followed by 27 per cent who feel that the demand would increase by up to 25 per cent.

52 per cent of the surveyed developers expect housing prices to increase in 2024.

25 per cent of the developers are willing to explore plotted developments as an alternative business model, followed by branded residences, which were preferred by 21 per cent of developers.

More than 80 per cent of developers believe that NRI demand for residential properties will increase.

Almost 50 per cent of the developers wish for a significant reduction in costs, either through tax rationalization or a decrease in interest rates.

"With significant new launches over the last two years, unsold inventory levels have expanded; thus, launches are expected to moderate in the near-midterm. Developers are likely to carefully monitor market trends and be more strategic while launching new projects," said Badal Yagnik, Chief Executive Officer, Colliers India.

Separately, commercial real estate services and investment firm CBRE requests the government to lower the GST on steel and cement -- the two key inputs.

The construction industry, experiencing rising construction costs over the last few years, saw some respite in 2023, with prices cooling off. In 2023, a gradual decline in material prices led to a tapering of costs.

CBRE further asserted that there is a demand to reduce the TDS rates on coworking spaces as most of the receivables from the client are towards services.

"The expectation is to bring coworking spaces into the 2 per cent TDS slab, as in the case of services, from the present 10 per cent. This will immensely help the coworking spaces segment in the management of their cashflows," said Anshuman Magazine, Chairman and CEO - India, South-East Asia, Middle East and Africa.