Max Life delivers superior customer services during COVID-19 with its Unique 'Speed Dial Partner for Life' program

Sep 22, 2021

New Delhi [India], September 22 (ANI/NewsVoir): Max Life Insurance Co. Ltd has delivered superior customer connect during COVID-19 pandemic with its unique 'Speed Dial Partner for Life' initiative.

Launched in the last fiscal year as an industry-first, under the Speed Dial Partner for Life initiative, Max Life assigns every customer a dedicated service relationship manager, known as the 'Partner for Life' for all their policy-related service needs.

The 'Partners for Life' are enablers, who provide a one-stop solution on call, shortening and cutting down any wait time a customer would have to go through to get their queries answered, and get dedicated attention to all their queries.

Over the last year, Speed Dial Partner for Life (SDPL) program was scaled up in size and base coverage, to cover over 80 per cent of Max Life's customer base. Furthermore, nearly 26 lac policy holders have been covered under this initiative, resulting in SDPL attaining Net Promoter Score of 70 as a touchpoint.

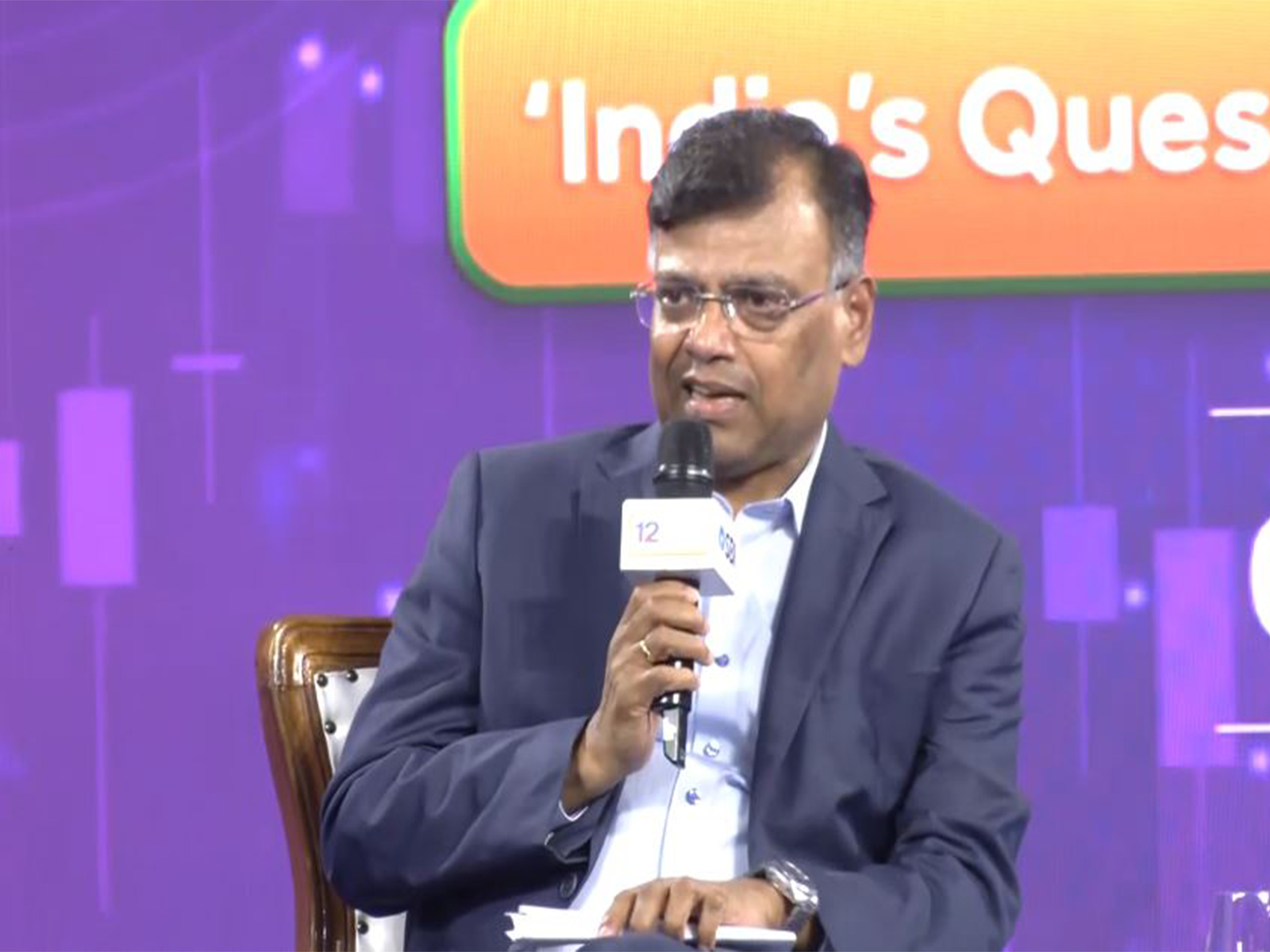

Commenting on the milestone, Manu Lavanya, Director and Chief Operations Officer, Max Life said, "Customer obsession is a central element of organizational values at Max Life. We are very proud of our industry first SDPL (Speed Dial Partner for Life) initiative, now in its second year, that is based on the simple premise of nurturing a continuous, long term relationship with our customers that is based on trust. We understand the need to transform our post-onboarding relationship with our customers from a transaction to a deep consumer centric relationship. We want to make the experience for customers as seamless as possible across all opportunities of engagement. Max Life aims to differentiate itself with exceptional customer servicing and digital solutions, and SDPL is one of our flagship initiatives to enable that experience."

A permanent contact number along with SDPL name is shared with the customer through various communication modes. Customer can interact with his/her SDPL on that one fixed number, without getting lost in IVR queue unlike a typical call centre. This also ensures that customer always has a point of contact for query resolution, even if the original sourcing agent is not available.

The service relationship manager also educates customers on the company's digital service solutions and new products offerings, if inquired, making the servicing more seamless.

Navigating the COVID-19 pandemic, Max Life Insurance has strengthened its commitment to customers by introducing a range of digital initiatives that are completely contactless and paperless.

The company has overhauled majority of the physical servicing touchpoints to digital and enabled more options of self-serve on its website - built an OTP authentication workflow, integrated their AI based chatbot 'Mili', to serve customers round the clock - among other digital offerings.

Max Life Insurance Company Limited is a Joint Venture between Max Financial Services Limited and Axis Bank Limited. Max Financial Services Ltd. is a part of the Max Group, an Indian multi-business corporation.

Max Life offers comprehensive protection and long-term savings life insurance solutions, through its multi-channel distribution including agency and third-party distribution partners. Max Life has built its operations over almost two decades through a need-based sales process, a customer-centric approach to engagement and service delivery and trained human capital.

As per public disclosures and annual audited financials for FY20-21, Max Life has achieved a gross written premium of INR 19,018 crore. As of 31st March 2021, the Company had Rs 90,407 crore of assets under management (AUM) and a Sum Assured in Force of Rs 1,087,987 crore.

For more information, please visit the company's website at

.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)