Misplaced Priorities?: Pakistan reluctant to reap sugar export benefits, lifts ban on 'luxury' goods

Jul 30, 2022

Islamabad [Pakistan], July 30 : Even if Pakistan has huge surplus sugar stock, yet, the government in a strange move, has retained the ban on sugar exports which has a potential to inject over USD 1 billion into the national exchequer, media reports said.

In stark contrast, Pakistan's federal cabinet on Saturday approved a decision by an economic committee to lift the ban on imports of luxury goods, media reports said.

Pakistan's local media outlet ARY News while quoting sources said that a total of 1.2 million tons of surplus sugar is available which is worth over USD 1 billion but, in a rather sorry state of affairs, the federal government was reluctant to lift the export ban.

Even though lifting the sugar exports ban can infuse huge cash still Pakistani government seems to be paying no heed to its virtues of it. It is worth noting that earlier it was suggested to the government to allow mills for exporting 500,000 tons of sugar in the first phase.

Despite the country facing a shortage of dollars and the slow pace of sugar exports, the Sugar Advisory Commission failed to take a decision on exporting surplus sugar.

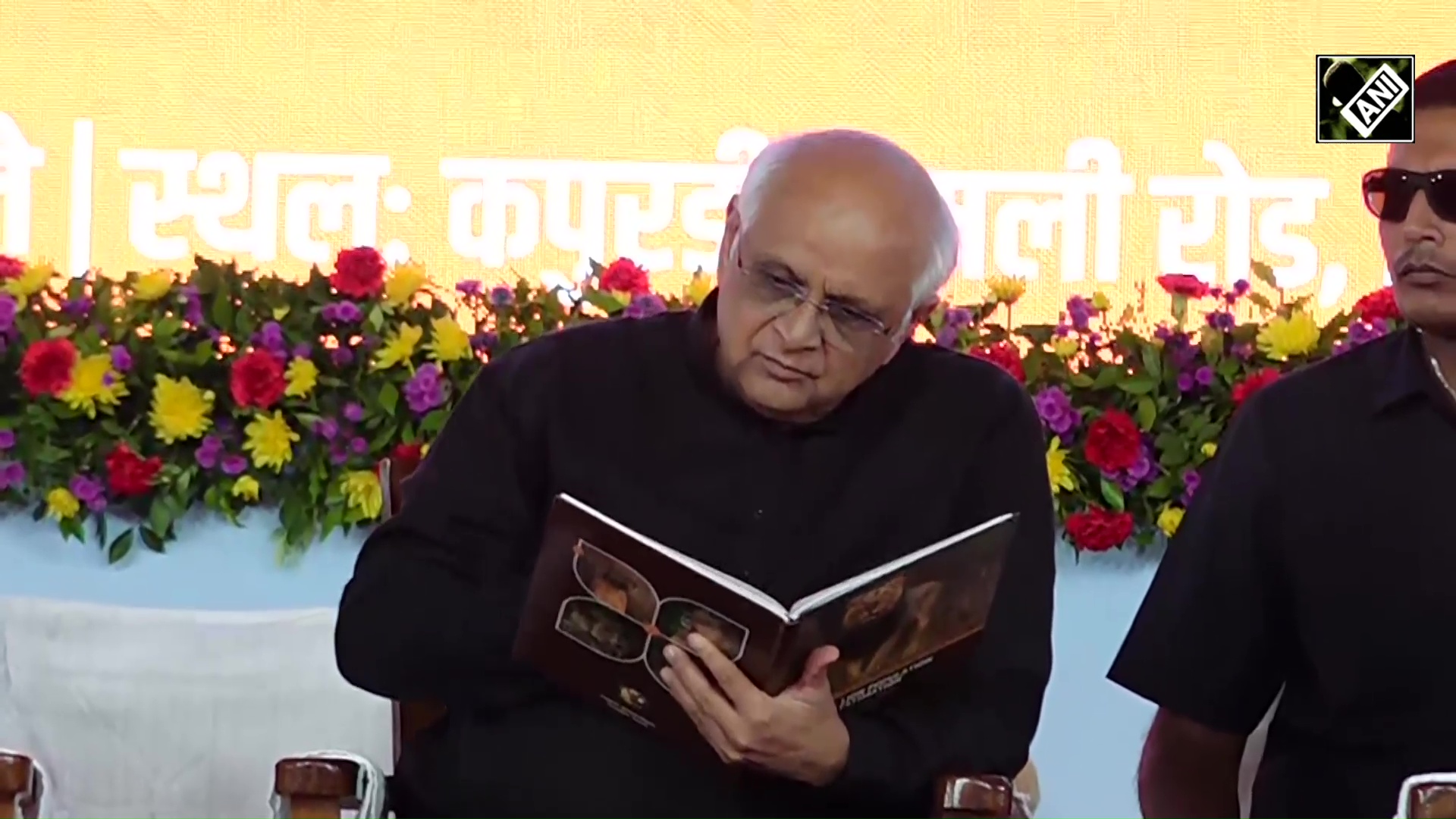

The country's Prime Minister Shehbaz Sharif, in May, ordered a complete ban on the export of sugar to stabilise the commodity price in the country. According to the Prime Minister's Office, PM Shehbaz Sharif had also ordered stringent measures against sugar smuggling.

Taking to Twitter, the prime minister announced on May 9 that he had directed for sternly dealing with hoarders, illegal profiteers and the elements involved in creating an artificial shortage of sugar.

It is worthy to note that the Pakistani government earlier scurried to ban the import of luxury items due to an alarmingly high trade deficit.

After the Economic Coordination Committee (ECC) reached a decision to lift the ban on the import of luxury items, the federal government approved the same, reported ARY News.

According to details, the ban on the import of luxury items such as cigarettes, chocolate and juices such as cosmetics, tissue papers, pet food, fish, footwear, fruits and dry fruits has been lifted.

Pakistan's Commerce Minister on May 20 notified a ban on the import of 38 non-essential luxury items under an "emergency economic plan".

Estimation is also building that goods like furniture, ice creams, jams and jellies, leather jackets, shampoo, sunglasses, ketchup, arms and ammunition, pasta, musical instruments, frozen meat, door and window frames, decoration articles, travel bags, suitcases, crockery and corn flakes can also be imported after lifting of the ban.

At the time of banning the import of luxury items, the country's Prime Minister Shehbaz Sharif had said that the decision was aimed at saving the country its precious foreign exchange.

He has also lambasted former Prime Minister Imran Khan's party PTI's "bad governance" which pushed the country into an economic mess.

In a tweet, Prime Minister Shehbaz Sharif said, "My decision to ban the import of luxury items will save the country precious foreign exchange. We will practice austerity & financially stronger people must lead in this effort so that the less privileged among us do not have to bear this burden inflicted on them by the PTI govt."

Meanwhile, Pakistan is currently battling with its fast-exhausting foreign currency reserves and widening fiscal and current account deficits, along with a rupee that has lost almost 20 per cent of its value in just 7 months since January 2022.

State Bank of Pakistan's reserves has fallen to as low as USD 9.32 billion, hardly enough to pay for 45 days of imports. The red line for SBP foreign currency reserves is USD 7.5 Billion to avoid "default".

Pakistan's political instability threatens to derail efforts to regain the confidence of key lenders. The country's currency endured its worst week in more than two decades, reflecting investors' worries that the country risks following Sri Lanka to become the next emerging economy to default on foreign repayments.