Moody's assigns Baa3 to Adani Ports' proposed bonds with negative outlook

Jul 13, 2020

Singapore, July 13 : Moody's Investors Service on Monday assigned a Baa3 rating to the proposed US dollar senior unsecured bonds to be issued by Adani Ports and Special Economic Zone Ltd (APSEZ).

The issuer rating and the rating of APSEZ's existing senior unsecured bonds remain unchanged at Baa3. The outlook on the ratings is negative," said Moody's.

APSEZ will use the majority of the proceeds to refinance its existing debt and that of its subsidiaries which could include Krishnapatnam Port Company, subject to the completion of its acquisition by APSEZ. The company will use the remainder of the proceeds for other general corporate purposes.

The bonds will represent a senior unsecured obligation and rank equally with all of APSEZ's existing and future unsecured and unsubordinated debt.

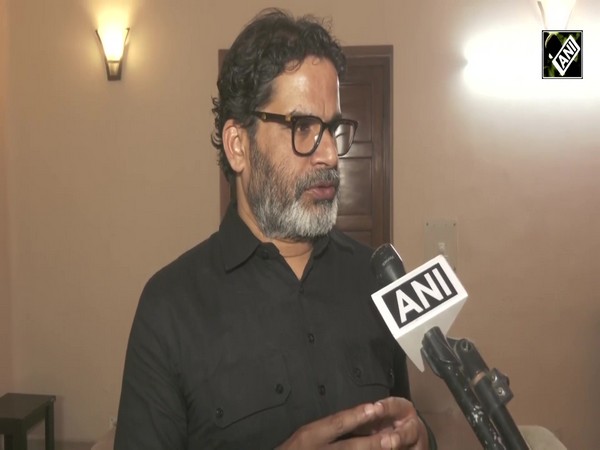

"As the proposed US dollar bonds rank pari passu (on equal footing) to all of APSEZ's existing and future unsecured and unsubordinated debt, the Baa3 rating of these bonds follows that of its existing senior unsecured bonds issued in 2017 and 2019 respectively," said Abhishek Tyagi, Moody's Vice President and Senior Analyst.

APSEZ's Baa3 issuer rating primarily reflects the company's strong market position as the largest port developer and operator in India by cargo volume. The rating also takes into consideration the long-term growth potential of India's economy as a whole, a key driver behind the large increase in the volume of traded goods over the past few years.

Despite a temporary reduction in trade volumes and revenue due to the coronavirus outbreak, Moody's expects that APSEZ's credit profile will withstand the impact of the coronavirus given its moderate financial profile and robust liquidity heading into the fiscal year ending March 2021 (fiscal 2021), as well as its ability to postpone capital spending.

APSEZ reported strong 8 per cent growth in container traffic in fiscal 2020 compared with the previous year, with container traffic contributing 41 per cent of its total cargo volume during the same period.

Moody's expects that APSEZ's performance over next two to three years will be driven by the ramp-up of capacity relating to its recently commissioned ports and terminals and its growing share of containers, with the addition of new terminals to its portfolio.

However, in the short term, APSEZ is operating in a challenging global economic environment as a result of the coronavirus outbreak and continued global trade tensions. As such, Moody's expects APSEZ's overall cargo volumes excluding contributions from acquisitions will decline by 10 to 12 per cent in fiscal 2021.

In addition, APSEZ's financial leverage as measured by funds from operations or debt should be in the 13 to 17 per cent range over the next 12 to 18 months. Such metrics are still appropriate for its Baa3 rating.