Office leasing in Pune recovering and inching towards 5.5 million sq feet in 2022: Colliers

Sep 16, 2022

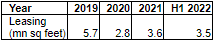

Pune (Maharashtra) [India], September 16 (ANI/PRNewsire): Grade A office absorption in Pune is expected to touch 5.5 million sq ft during 2022, a likely 53 per cent increase from last year when demand was marred by the lockdowns. Occupier confidence is back in the market, with demand backed by Flex, Consulting and Tech occupiers. Office space leasing jumped five-fold to 3.5 mn sq feet YoY in H1 2022. Flex operators led the demand at 34 per cent share in total leasing, leased 1.2 mn sq feet of space in the city. Vacancy levels declined 50 basis points amidst robust demand; rentals set to improve.

During H1 2022, office absorption already crossed 3.5 mn sq feet, a five-fold rise from the same period last year. The H1 2022 demand has already surpassed H1 2019 demand by 120 per cent. Year 2019 saw the highest ever annual office space absorption.

Leasing trends (mn sq feet)

Source: Colliers

Note: Data pertains to Grade A buildings

With reducing occupier exits and a surge in demand, occupancy levels in the city are improving. After a gap of two years, overall vacancy levels dipped by 50 basis points on a QoQ basis. Average rents in Pune also saw a marginal increase of 1.5% during Q2 2022. The next couple of quarters are likely to drive rental growth further, as demand is likely to remain robust.

Trends in Grade A vacancy

Source: Colliers

"Leasing momentum is strengthening every quarter and occupier enquiries remain upbeat. This suggests that offices will continue to take center stage in the working ecosystem and are already witnessing growth. Pune remains a promising location for corporate and India due to its infrastructure advancements, employment opportunities, a significant proportion of the millennial workforce, and attractive real estate pricing. During H1 2022, leasing by flex operators in Pune totaled 1.2 mn sq feet, the highest seen across the top six cities. Large occupiers are also turning towards flex as a part of their hybrid working policy, providing flexibility to their employees. A healthy supply pipeline of about 25 mn sq feet in next 3 years will offer a variety of options to occupiers across multiple micro-markets," said Animesh Tripathi, Managing Director, Pune, Colliers.

Flex space leading the growth in a hybrid world

Flex space contributed to 34 per cent of the total leasing in Pune, outpacing the Technology sector which accounted for a 15 per cent share in total leasing. Flex spaces in Pune are seeing renewed demand with many large enterprises incorporating a flex space component in their portfolio. Various flex space operators expanded their footprints in the city during H1 2022 through select large deals (>1,00,000 sq feet) in good-quality Grade A buildings. About 80% of the total flex leasing was through large deals signaling occupiers' strong preference for utilizing flex spaces. Baner and Off-CBD east (Kalyani Nagar, Koregaon Park, Viman Nagar) are the thriving flex micro-markets which witnessed maximum leasing activity due to their robust social and physical infrastructure, and proximity to key residential locations. In the coming quarters as well, demand for flex space will continue to be robust, as large occupiers continue to pivot towards flex spaces to embrace hybrid work.

Flex leasing trends

Source: Colliers

Note: Data pertains to Grade A buildings

"This is a critical time for occupiers to make strategic decisions about their workplace strategies. Flex space is no longer a stop-gap arrangement for occupiers but is a permanent part of their office portfolio. As a thriving location for IT companies, startups and entrepreneurs, Pune will continue to receive huge demand for flex spaces in the coming years," Vimal Nadar, Senior Director, Research, Colliers India.

Colliers (NASDAQ: CIGI) (TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 63 countries, our 17,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 27 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of 20 per cent for shareholders. With annual revenues of USD 4.5 billion and USD 81 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people.

Sukanya Dasgupta

Senior Director & Head, Marketing & Communications| Colliers India

+91 9811867682

Riddhi Vira

Manager, Public Relations | Colliers India

+91 9619776362

This story is provided by PRNewswire. ANI will not be responsible in any way for the content of this article. (ANI/PRNewswire)