Options given for bridging GST revenue shortfall will put onerous burden on states: Kejriwal

Sep 01, 2020

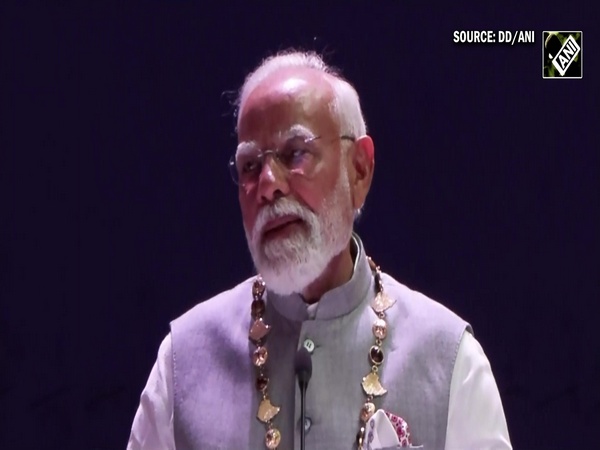

New Delhi [India], September 1 : Delhi Chief Minister Arvind Kejriwal on Tuesday wrote a letter to Prime Minister Narendra Modi stating that the two options that have been given to states by the Finance Ministry to make up for shortfall in the goods and services tax (GST) compensation cess fund will put an onerous burden on the states.

He appealed to Prime Minister to consider "a much more simpler and legally sustainable" option of borrowing by the government to the full extent of the requirement of compensation in the year 2021 and 2022, to be serviced and repaid by the future collection of cess with effect from 2022.

Kejriwal said in the letter that the two options of borrowing presented by Finance Ministry which primarily require the states to borrow and then meet "the repayment liabilities will put an extremely onerous burden on the states which are reeling under the financial crisis due to the shortfall in the revenue collections and an increased commitment of expenditure emerging from COVID-19 response".

The letter said that Goods and Services Tax (Compensation to States) Act, 2017 very clearly provides for compensation to the states for the loss of revenue arising on account of the implementation of the GST in pursuance of the provision of the Constitution (101st Amendment Act, 2016).

"To create an artificial distinction between loss occurring due to the implementation of the GST and those occurring due to COVID-19 pandemic goes against the very spirit of the Compensation Act and will lead to a creation of a trust deficit between the Centre and the states," he said, adding that the states will be hesitant in coming together to achieve more such larger common national goals, as was done through the implementation of GST.

The Chief Minister also said that options proposed by the Centre will lead to a cumbersome process of borrowing by states, crediting the debt amount to GST compensation fund and thereafter release of such funds as may be due to the states from the Compensation Fund.

He said the servicing and ultimate repayment of a loan through the states will also be similarly "cumbersome and circuitous".

"Considering the above situation, it is my humble submission that the Government of India may like to consider a much more simpler and legally sustainable option of borrowing by the government to the full extent of the requirement of compensation in the year 2021 and 2022, to be serviced and repaid by the future collection of cess w.e.f 2022," he said.

"For this purpose the GST Council may consider to authorize the Government of India to borrow on its behalf and extend the period of collection of cess beyond the year 2022. I am informed this was the consensual opinion of majority of the States during the deliberations held in the 41st GST Council meeting," he added.

The Centre has given two options for compensating states on the Goods and Services Tax (GST) to bridge revenue shortfall as the economy faces a prospect of contraction in the current fiscal year due to COVID-19 crisis.

The first option provides a special window to states in consultation with the Reserve Bank of India (RBI) to provide Rs 97,000 crore at a reasonable rate of interest. This money can then be repaid after five years from the collection of cess.

The second option is that the entire GST compensation gap of Rs 2.35 lakh of this year can be met by states in consultation with the RBI.