Over 7,000 income tax cases disposed of through faceless assessment system

Jul 19, 2020

New Delhi [India], July 19 : The Income Tax department has disposed of as many as 7,000 cases under the first phase of the faceless assessment system, a highly placed source in the Finance Ministry said on Sunday.

"The faceless assessment system of Income Tax Department has been a game-changer in the arena of direct taxation. It has empowered the taxpayers and has, as a foremost mechanism, altered the facets and perception of overall tax administration in India. Over 7,000 income tax cases disposed of through faceless assessment system", the source said.

Since its launch on October 7 last year and implementation of the first phase, the system has provided for assessment of income-tax in electronic mode, where "taxpayers now need not see face-to-face any tax officer or visit an I-T office and need not run pillar-to-post on receiving income tax scrutiny assessment notice or rush to a tax professional or accountant; and yet, s/he can e-file assessment's reply on the income tax portal from the comforts of her/his home without the hassle of visiting any tax officer. Yes, time is changing for direct tax administration in India with automated and random allocation of income tax assessment cases without human interface at any stage", added the source.

According to sources other than the one quoted above, in the first phase of the faceless assessment, a total of 58,319 cases were assigned in an automated way randomly and these were kept away from the geographical jurisdiction of the case, based on the computer algorithms. Of which 7,116 cases, as on date, have been disposed of with assessment orders issued without any additions and 291 cases wherein additions are proposed to be made, have been submitted to risk management unit.

Sources said that in all the above cases, the grievances of over-pitched assessment or harassment by the taxpayers/tax professionals have been almost eliminated.

"The taxpayers have been advised to check their registered e-filing accounts/email ids for notices or updates. Now, all the communications with taxpayers are made electronically by a central cell in Delhi and the identity of all the assessing officers remains unknown to the taxpayers at all times," said sources

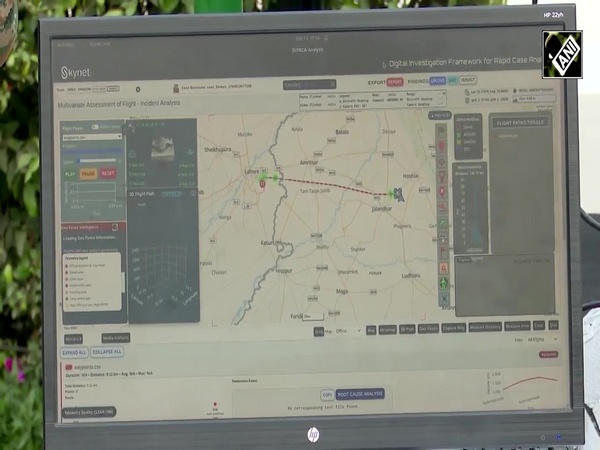

It may be noted that under the faceless assessment, the Income Tax Department has created state-of-the-art digital technology for risk management by way of automated examination tool, artificial intelligence and machine learning, with a reduced discretion or no human interface from the Income Tax Department. Faceless Assessment has further brought in the concept of team-based assessment with dynamic jurisdiction and has, thus, induced enhanced transparency, improved efficiency, and superior standardisation of procedures.

It is pertinent to mention here that the faceless assessment was put to work under the National Assessment Center (NeAC), with headquarters in Delhi and eight Regional Assessment Centers (ReAC) at Delhi, Mumbai, Chennai, Kolkata, Ahmedabad, Pune, Bengaluru and Hyderabad which comprise Assessment units, Review units, Technical units and Verification units.

Explaining this major reform in the income tax processes, the finance ministry sources said that now almost 99 per cent returns are e-filed.

"Out of more than six crore returns filed annually, only about three lakh returns come under scrutiny on the basis of select risk parameters. Cases are centrally selected for scrutiny using Computer-Aided Selection for Scrutiny. Some scrutiny cases are also selected manually on the basis of specified criteria. Old assessments can also be re-opened if the Assessing Officer has sufficient reason to believe that some income has escaped assessment," sources said.

Sources said that earlier, during assessment proceedings in scrutiny cases taxpayer or her tax professional/s were required to make multiple visits to the income tax office.

"There were allegations and some incidences of discretion and subjective approach which often resulted in high-pitched assessments. In tax recovery proceedings, almost similar types of allegations were being made. This was one of the concerns to rectify the income tax processes by becoming faceless. However, the main reason is to provide convenience to taxpayers," sources said.

It may be recalled that Prime Minister Narendra Modi in 2017 had desired that tax assessments should be anonymous, thereby eliminating discretion and physical interface. Towards this goal, Finance Minister Nirmala Sitharaman had announced the scheme of faceless assessment in her budget speech on July 5, 2019, which was subsequently inaugurated on October 7, 2019.

Sources said that the new Form 26AS which has been notified from June 1 is in the nature of the Annual Information Statement.

"The Old Form--26AS contained limited information pertaining to tax payments and TDS/TCS only. In the new Form 26AS much more information is uploaded such as Specified Financial Transactions (Property, bank, shares, mutual funds), payment of taxes, Tax Deducted or Collected at Source, Income tax demand, and refund, pending and completed income tax proceedings," sources said.

"This would be faceless hand-holding of the taxpayers to ease them e-file their income tax returns quickly and correctly; besides nudging some taxpayers to disclose income relating to transactions displayed in the New Form - 26AS and to pay taxes rightly. This will also help in verifying all available information in a faceless manner and help in seamless implementation of the first phase of Faceless Assessment", said the sources.