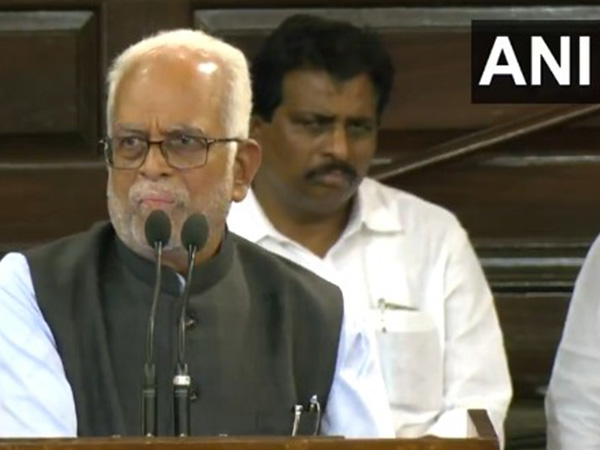

"Probe China link to political voices that targeted Adani group on Hindenburg report": Mahesh Jethmalani

Jul 19, 2024

New Delhi [India], July 19 : Senior lawyer and BJP leader Mahesh Jethmalani has called on the government to probe the links of political voices, who sought to target the Adani group after the Hindenburg report, with China. He had recently flagged Chinese hand behind the report by the American short seller Hindenburg that targeted the Indian coglomerate.

In January 2023, Hindenburg published a report accusing the Adani Group of financial irregularities, leading to a significant drop in the company's stock price. The group at the time had rubbished these claims.

Senior advocate Jethmalani on Friday alleged that the hit job on the Adani group was Chinese vengeance for losing out on infrastructure projects like the Haifa Port.

"Now that there's an established Chinese hand behind the Hindenburg hatchet job on the Adani group it behoves the GOI to probe the linkages between the loudest political voices that pre and post the publication of the Hindenburg report savaged the government for its 'crony capitalism.' The hit job on the Adani group was Chinese vengeance for losing out on strategic mining and infrastructure project bids, one of the most crucial of which was the bid for the Israeli port of Haifa," Jethmalani said.

"Shockingly some Indian politicians seemed deeply aggrieved by Adanis Haifa port success- a strategic acquisition key to the viability of IMEC- an economic corridor of India, the Middle East and Europe meant to compete with and improve upon China's BRI-Belt and Road Initiative. This wilful support for a hostile nations debt trap initiative at the cost of the IMEC initiative cannot but lead to a strong inference that a part of our political class is bent upon aligning itself with Chinese strategic interests. Add to this the colossal loss to retail investors by an influential and wealthy Chinese American mired in espionage controversy for the Chinese State in the US and the case for an investigation into Chinas flag bearers in India is compelling," he further added on his social media platform X.

Earlier this month, Jethmalani alleged that a China lobbyist made huge gains by short selling the Adani stock.

"There is no doubt that The China Project and its founder Anla Cheng were CCCP lobbyists as attested to by ex employee Shannon Von Sant before the US Congress. In November 2023, The China Project shut down on the ground that a 'source of funding that it was counting on' did not come through and allegations regarding 'its nefarious designs' were widespread in both China and the US making it unviable to survive on subscriptions only. While the Project was undoubtedly mired in espionage charges in the US, the anticipated source of funding which did not materialise was not disclosed and is shrouded in mystery," Jethmalani said in a post on 'X' on July 9.

"What is now in the public domain however is that Cheng and family made a fortune short selling Adani stock in January/February 2023 (around USD 25 million at the very least)a fraction of which speculative gain could easily have funded the Project. Did the USD 40 million which they invested in the Adani short sale and gains accruing from it not belong to them? Who then did it belong to? The Chinese State or a private actor? Was the expected money that the Project was denied a share of the Adani short sale gains? Were they therefore only a front? Had Kingdon, Cheng and family short traded in the Indian markets before? And why Adani stocks ?" he added in the post.

On July 5, Jethmalani had said that Anla Cheng along with her husband Mark Kingdon hired Hindenburg for a research report on Adani. He also posted the detailed statement of Shanon Von Sant to the US Congress and raised question about who had profited from the short selling of the stock.

"Who eroded Adani market cap enormously, with no thought for several Indian retail investors who they financially decimated through their nefarious design to promote Chinese strategic interests by destroying an Indian corporate competitor who had prevailed in many bids over the Chinese State in strategic international projects; and whose interests and activities were robustly promoted within India by the desperate to survive I.N.D.I alliance by camouflaging their sell out to the Chinese State in the guise of attacking "crony capitalism"," read his post on X on July 5.

Earlier on July 15, the Supreme Court dismissed the review petition against its earlier judgment which refused to constitute the court-monitored Special Investigation Team (SIT) probe into the Adani-Hindenburg issue over allegations of stock price manipulation by the Indian corporate giant.

"Having perused the review petition, there is no error apparent on the face of the record. No case for review under Order XLVII Rule 1 of the Supreme Court Rules 2013. The review petition is, therefore, dismissed," a bench headed by Chief Justice DY Chandrachud said.

The January 24 Hindenburg report alleged stock manipulation and fraud by the conglomerate. The case is related to the allegations (part of a report by short-seller Hindenburg Research) that Adani had inflated its share prices. After these allegations were published, it led to a sharp fall in the share value of various Adani companies, reportedly to the tune of USD 100 billion.

The Adani Group had dismissed the charges as lies, saying it complies with all laws and disclosure requirements.