Punjab National Bank launches 34 new products on its 131st Foundation Day

Apr 12, 2025

New Delhi [India], April 12 : Punjab National Bank (PNB), the nation's leading public sector bank, celebrated its 131st Foundation Day, commemorating over a century of resilience, trust, and customer-centric banking, a release said on Saturday.

According to the release, the celebration at the PNB Headquarters in Dwarka, New Delhi, witnessed participation from distinguished dignitaries, bank executives, employees, and customers, reflecting the bank's steadfast dedication to innovation, financial inclusion, and digital transformation.

M Nagaraju (DFS Secretary), Ashok Chandra (PNB MD&CEO), and the PNB EDs Kalyan Kumar, M Paramasivam, Bibhu Prasad Mahapatra, and D Surendran were present on the occasion.

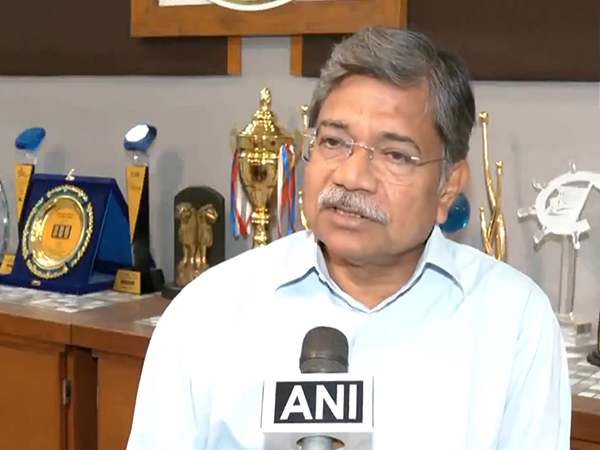

M Nagaraju, Secretary, Department of Financial Services (DFS), commended PNB for its innovative product offerings, highlighting their significant contribution to deepening financial inclusion and enhancing customer experience. He also appreciated the bank's proactive initiatives in promoting cyber awareness among citizens, reinforcing its commitment to secure and responsible banking.

Ashok Chandra, MD & CEO, PNB, expressed his gratitude to stakeholders and stated: "PNB has been a cornerstone in India's development, offering credit across every sector and ensuring financial inclusion throughout the nation. Our initiatives have supported the underprivileged, empowered citizens, educated the youth, increased farmers' income, and fostered entrepreneurship--all aligned with the vision of a Viksit Bharat by 2047. As a customer-first bank, we are continuously refining our grievance redressal system, improving call center operations, and leveraging QR codes for effective customer feedback to enhance service quality."

PNB's 131st Foundation Day was marked with the launch of 34 new banking products and services, including 12 customer-centric deposit schemes and 10 digital transformation products.

Among the deposit products rolled out are schemes for salaried professionals, women, defence personnel, farmers, NRIs, senior citizens, pensioners, students and youth. Key features across these schemes include customised account numbers, personal accident and life insurance, healthcare benefits, and upgraded debit card functionalities.

Some of the flagship offerings include PNB Salary Savings Account (Neo, Excel, Optima, Imperial), PNB Women Power Scheme (Pearl, Emerald, Solitaire), PNB Kisan Saving Fund (Harit, Samriddhi), PNB Rakshak Plus (for armed forces and police personnel), PNB Samman Account (for senior citizens and pensioners), among others.

The bank has also introduced a QR code-based customer feedback mechanism, a live-chat assistant "Pihu", and new internal banking functionalities for enhanced customer service.

As part of its digital roadmap, PNB also launched 10 new tech-driven services, including single-window DEMAT and trading account onboarding, digital loan facilities against deposits, WhatsApp-based fixed deposit bookings, and enhancements to the PNB One Biz app. Other key digital initiatives include GST Express Loans for new-to-bank customers up to Rs 1 crore, Digi MSME Loans up to Rs 25 lakh, Self-Onboarding for Savings and PPF accounts, and Loans for rooftop solar installations, among others.

In alignment with its social responsibility vision, PNB, in partnership with PNB PRERNA -- an association comprising of senior women officials of the bank and the wives of senior bank officials whose primary goal is to support and promote the bank's CSR efforts -- also announced new CSR collaborations.

The Bank partnered with Kalinga Institute of Social Sciences (KISS) foundation to support the wellbeing and literacy of underprivileged indigenous students of Bhubaneshwar and with Water for People India Trust to facilitate its project "Harvest for Resilience". PNB also donated infrastructure items to government schools in Delhi.

The event concluded with spirited cultural performances by the PNB Parivaar and soulful music by renowned singers Meiyang Chang and Jahnvi Shrimankar, the release added.