RBI cuts key interest rates, forecasts H1 FY21 GDP growth to contract on COVID-19 impact

May 22, 2020

Mumbai (Maharashtra) [India], May 22 : The Reserve Bank of India (RBI) on Friday unveiled a series of measures to minimise the impact of coronavirus (COVID-19) pandemic and subsequent countrywide lockdown which is likely to contract GDP growth rate in the first half of current financial year (H1 FY21).

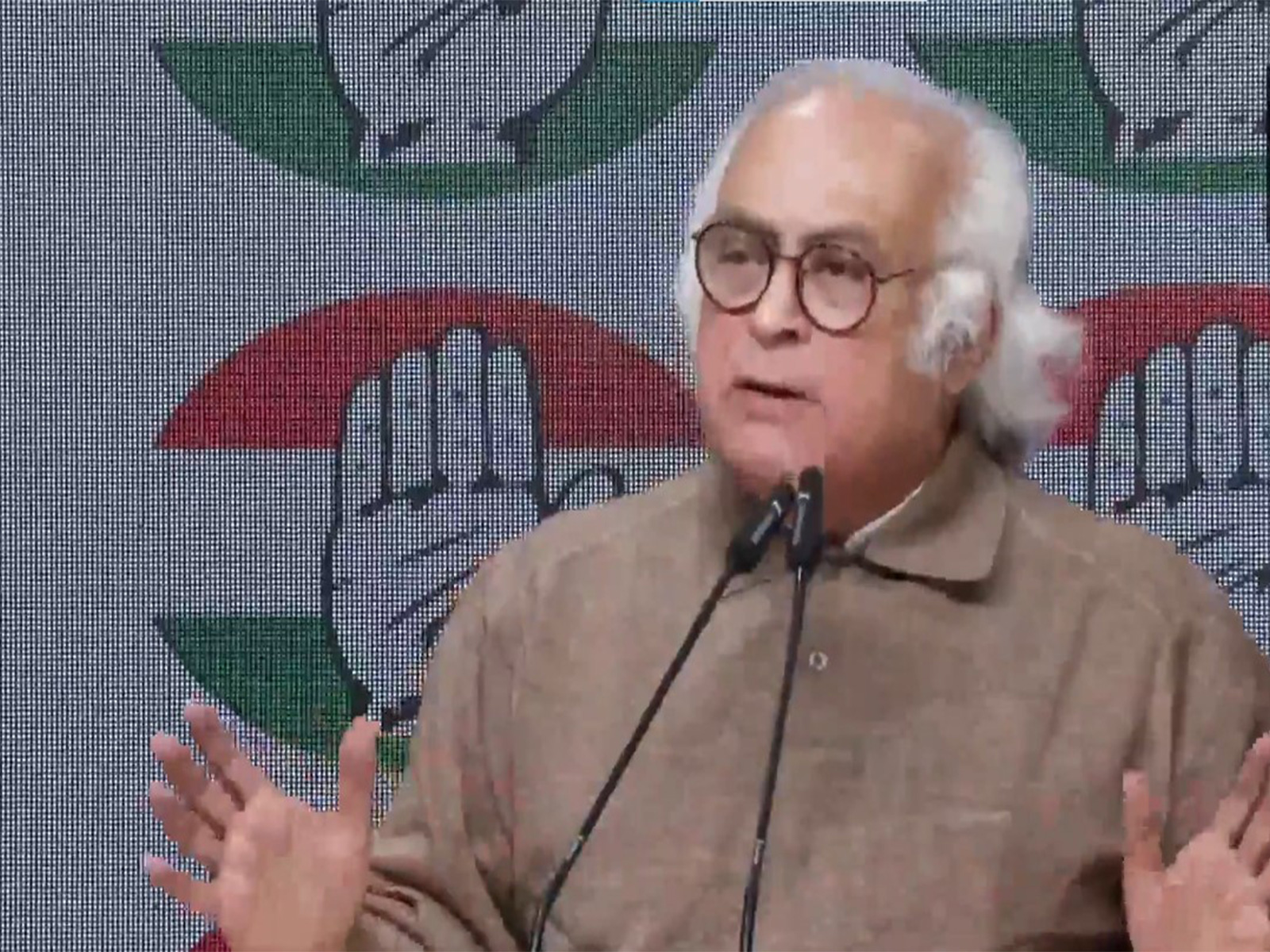

The central bank cut repo rate by 40 basis points to 4 per cent. The reverse repo rate now stands at 3.35 per cent, said RBI Governor Shaktikanta Das. The six-member monetary policy committee (MPC) voted 5:1 in favour of the decision.

Repo rate is the rate at which a country's central bank lends money to commercial banks, and reverse repo rate is the rate at which it borrows from them.

The RBI also extended the loan repayment moratorium for another three months up to August 31. It increased the group exposure limit of banks from 25 to 30 per cent of eligible capital base for enabling corporates to meet their funding requirements from banks. The increased limit will be applicable up to June 30, 2021.

Besides, the MPC decided to continue with the accommodative stance as long as it is necessary to revive growth and mitigate the impact of COVID-19 on the economy while ensuring that inflation remains within the target.

"Economic activity other than agriculture is likely to remain depressed in Q1:2020-21 in view of the extended lockdown," said RBI Governor Shaktikanta Das.

"Even though the lockdown may be lifted by end-May with some restrictions, economic activity even in Q2 may remain subdued due to social distancing measures and the temporary shortage of labour."

Recovery in economic activity is expected to begin in Q3 and gain momentum in Q4 as supply lines are gradually restored to normalcy and demand gradually revives, he said.

For the year as a whole, said Das, there is still heightened uncertainty about the duration of the pandemic and how long social distancing measures are likely to remain in place and consequently, downside risks to domestic growth remain significant.

"On the other hand, upside impulses could be unleashed if the pandemic is contained, and social distancing measures are phased out faster."

Das said the MPC is of the view that the macroeconomic impact of the pandemic is turning out to be more severe than initially anticipated and various sectors of the economy are experiencing acute stress.

"The impact of the shock has been compounded by the interaction of supply disruptions and demand compression. Beyond the destruction of economic and financial activity, livelihood and health are severely affected. Even as various measures initiated by the Government and the Reserve Bank work to mitigate the adverse impact of the pandemic on the economy, it is necessary to ease financial conditions further," said Das.

"This will facilitate the flow of funds at affordable rates and revive animal spirits. With the inflation outlook remaining benign as lockdown-related supply disruptions are mended, the policy space to address growth concerns needs to be used now rather than later to support the economy, even while maintaining headroom to back up the revival of activity when it takes hold."

Das said high-frequency indicators point to a collapse in demand beginning March across both urban and rural segments. Electricity consumption plunged while both investment activity and private consumption suffered precipitous declines, as reflected in the collapse in capital goods production and the large retrenchment in the output of consumer durables and non-durables in March.

The indicators of service sector activity like passenger and commercial vehicle sales, domestic air passenger traffic and foreign tourist arrivals also experienced sizable contractions in March.

The only silver lining was provided by agriculture, with the summer sowing of rice, pulses and oilseeds in the country progressing well, with total area sown under the current Kharif season up by 43.5 per cent so far, and the rabi harvest promising to be a bumper as reflected in record procurement.

On the other hand, retail inflation measured by the consumer price index moderated for the second consecutive month in March 2020 to 5.8 per cent after peaking in January. This was mainly due to food inflation easing from double digits in December 2019 to January 2020.

In April, however, supply disruptions took a toll and reversed the softening of food inflation, which surged to 8.6 per cent from 7.8 per cent in March. Prices of vegetables, cereals, milk, pulses and edible oils and sugar emerged as pressure points.

In the external sector, India's merchandise trade slumped in April with exports shrinking by 60.3 per cent and imports by 58.6 per cent year-on-year respectively.