Real estate sector well-placed to absorb RBI's another rate hike, says Anarock

Sep 27, 2022

New Delhi [India], September 27 : With the inflationary pressures evident across the globe, many countries have been witnessing back-to-back interest rate hikes. India too is closely knit to the global economy and had to take remedial actions to control inflation, which is driven by domestic and global factors.

Like many other sectors, the interest rate-sensitive Indian real estate sector too is somewhat impacted by the ongoing trajectory of the monetary policy tightening by various central banks.

The RBI cut interest rates from 5.15 per cent when the pandemic hit to as low as 4 per cent, which then boosted real estate assets. The repo rate now stands at 5.4 per cent as of now.

Faced with sticky and elevated inflation numbers due to of a surge in crude oil prices and the geo-political tensions, the RBI starting this May started raising interest rates back towards the pre-Covid levels.

Now the question arises whether another rate hike by the Indian central bank impact housing demand.

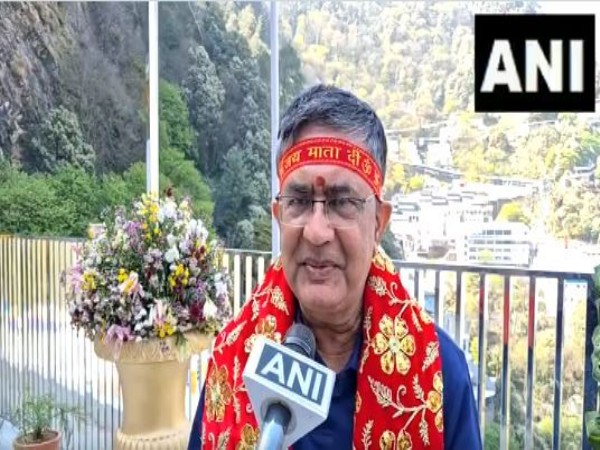

"This is less than likely. To begin with, it had always been clear that the low-interest rate regime was a short, sweet, and ultimately unsustainable interlude. It was required during and immediately after the worst Covid-19 waves, which had seriously intimidated Indian consumers at all levels," said Anuj Puri, Chairman of property consultancy and real estate services provider ANAROCK Group.

Declining interest rates were a key reason for the massive housing demand surge in the past two years.

"Also, the pandemic reinstated the importance of owning physical assets like real estate. This time around, the demand revival even included the previously rent-favouring millennials - who continue to be on the market for homes," Puri said.

It is widely expected the RBI may hike rates by 50 basis points in the monetary policy review meeting during September 28-30, while Puri argues hike of such magnitude would not seriously hamper homebuyers' sentiments.

"Moreover, the festive season is around the corner. This is a period when developers usually roll out various freebies and offers, and we may even see fixed interest rate guarantee plans announced this year," he added.

Homebuyers are expected to zero in on the developers' offers, which will help reduce the overall transaction costs pressure.