Record decline in securitisation volumes due to Covid-19: ICRA

Aug 04, 2020

New Delhi [India], Aug 4 : The securitisation volumes declined substantially in Q1 FY21 to Rs 7,500 crore from Rs 50,300 crore in Q1 FY20 primarily due to disruptions caused by the Covid-19 pandemic, investment information firm ICRA said on Tuesday.

The nationwide lockdown severely impacted the income generation capability of large number of borrowers. This made the investors vary of investing in fresh securitisation transactions given the possible deterioration in the loan repaying capability of retail borrowers.

The Reserve Bank of India's loan moratorium policy provided relief to retail borrowers but was detrimental to securitisation market as investors stayed away from pools with irregular cash flows in the initial months.

Further, said ICRA, the funding requirements for non-banking finance companies and housing finance companies also declined during this quarter due to lower demand from the borrowers and the increased focus of the on collections rather than disbursements.

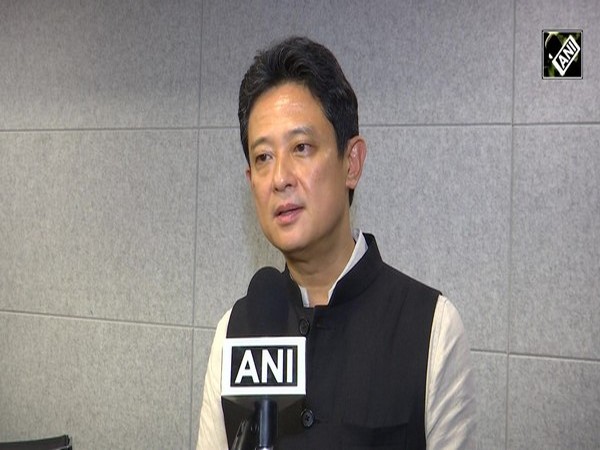

"Though the securitisation volumes were significantly lower during Q1 FY21, the market saw an uptick in volumes in June. More than two-third of the total volumes in Q1 FY21 were completed in June," said Abhishek Dafria, Vice President and Head of Structured Finance Ratings at ICRA.

"We expect the overall volumes to see further increase in the coming quarters supported by the improvement in collections being seen across asset classes that will restore investor confidence," he said in a statement.

"We estimate that annual securitisation volumes should remain significantly lower in FY21 than the preceding fiscal at about Rs 1.2 lakh crore to 1.3 lakh crore, given the impact of pandemic and the lower availability of eligible pools for securitisation."

Commercial vehicle loans emerged as the leading asset class accounting for around 31 per cent of overall volumes in Q1 FY21. Some of the transactions in this segment were initiated towards end of FY20 though were executed in the current fiscal.

The share of mortgage-backed securitisation transactions continued to shrink. Mortgages, which accounted for around 48 per cent overall volumes in Q1 FY19, witnessed a reduction in share to 26 per cent in Q1 FY21 due to exit of a few large-size originators in recent years from securitisation market.

Share of gold loan segment increased to 32 per cent of the total volumes in Q1 FY21 as against 13 per cent in Q1 FY20. Investor appetite for gold loan securitisation was supported by secured nature of the asset class which is also highly liquid security, better yields and stable portfolio performance.

The rise in gold prices in the past quarter also improve the loan-to-value ratio from the lenders' perspective reducing chances of any loss, said ICRA.