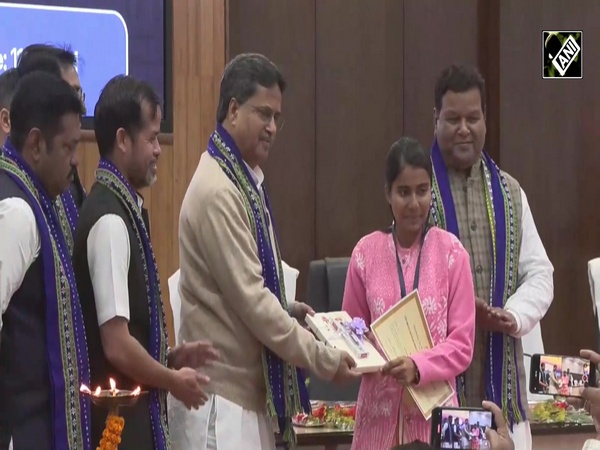

Reforms carried out by government acknowledged by rating agencies: CEA

Jun 11, 2020

New Delhi [India], June 11 : Reforms undertaken by the government have been recognised by rating agencies who are anticipating higher growth and have also shown greater confidence in India's growth story, Chief Economic Advisor Krishnamurthy Subramanian said on Thursday.

He was commenting on the growth forecast of global rating agencies S&P Global and Fitch Ratings.

S&P Global ratings on Wednesday retained India's lowest investment grade (BBB-) credit rating with stable outlook and Fitch Ratings said that Indian economy would register a sharp growth rate of 9.5 per cent next year if it manages to avoid further deterioration in its financial sector.

Talking to media persons through video conferencing, the CEA said that overall ratings being maintained and outlook being stable is good news especially from the perspective of the proposal in this year's budget for inclusion of Government of India bonds in the sovereign bond indices.

"This clears the path for us to proceed ahead on that move," he said.

Subramanian said that at the start of this financial year in April "when we were in the first few weeks of the lockdown, we had estimated the growth will be between 1.5 to 2 per cent".

"That was conditioned on V-shape recovery in the second half of the year. I have mentioned earlier that the V-shaped recovery itself is driven by evidence of what was seen in the Spanish flu episode which is only other pandemic that comes close to COVID-19," he said.

He said it is important to keep in mind that even though Spanish flu episode was far more devastating with one-third of the global population having been infected, today about one per cent population is infected by COVID-19.

"It's one-third versus one per cent. The mortality rates were about 10 per cent in Spanish flu, it's about 3.4 per cent globally in COVID-19. Despite that, there was a V-shaped recovery. What is uncertain though is whether that recovery will happen in the second half of the year or will it happen in next year. The actual growth, therefore, will really depend critically on the recovery in the second half," he said.

Subramanian said that the government is working on a "large range" of growth estimates for this year and recovery in growth in H2 or next year are also part of government's baseline expectations.

He said that the government has evaluated various options like fiscal deficit, monetary and liquidity measures and evaluated their pros and cons.

Replying to a question, he said that banking will be a part of strategic sectors for privatization.