Religare Broking recommends SBI shares, sees 24 pc potential returns on investment

Feb 06, 2023

New Delhi [India], February 6 : Religare Broking has recommended investors bet on State Bank of India (SBI) shares with potential returns on investment of about 24 per cent.

With the current market price of Rs 544 per share, the brokerage pegged the target price at Rs 677.

The "Buy" rating by the brokerage comes on the backdrop of SBI having reported the highest ever quarterly profit for the second successive quarter with 68 per cent higher year-on-year.

The profit rise can be attributed to improved margins and enhanced asset quality.

Further, the bank's deposits saw a growth of 10 per cent on a yearly basis and 0.6 per cent on a quarterly basis, which the brokerage said is in line with the industry growth.

Religare Broking expects deposits to grow at a CAGR of 11 per cent for the period FY22-FY25.

"We remain positive on the bank due to the robust and sustainable credit demand, improving asset quality, better margins which is adding up to strong earnings growth and banks declining credit cost and cost to income ratio," the brokerage added.

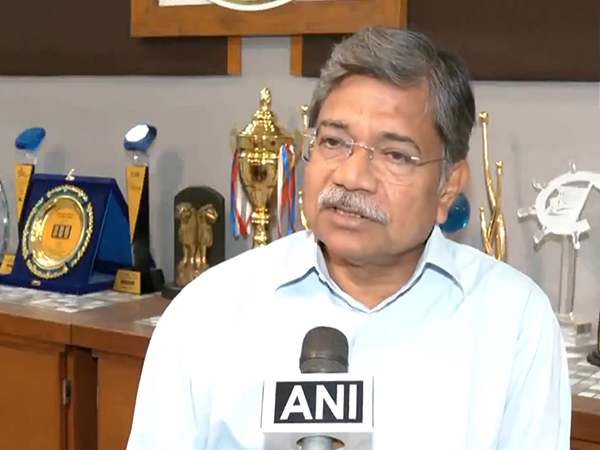

Meanhile, on Friday, addressing a press conference after announcing October-December quarter earnings, SBI chairman Dinesh Khara said the bank's total exposure amounting to Rs 27,000 crore in Adani Group is 0.88 per cent of its loan book.

"We have lent to Adani (group) for projects having tangible assets and adequate cash. They have met obligations...our total exposure to Adani group is 0.88 per cent as of December 31," Khara said.

Khara added that loans were against assets or cash-generating businesses, and the bank does not see any challenge.

This comment by the SBI chief comes almost a week after a report by a US-based Hindenburg Research, which claimed the Adani Group of having weak business fundamentals, allegations of stock manipulation and accounting fraud, among others.