Removal of export duties on steel is the Indication of good times ahead - Vedant Goel, MD, Neo Mega Steel LLP

Nov 21, 2022

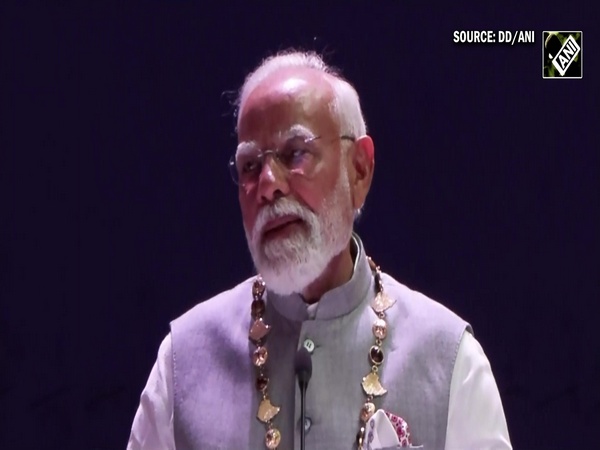

New Delhi [India], November 21 (ANI/ATK): India can surely make it to the USD 5 trillion club where the right decisions are made at the right time.

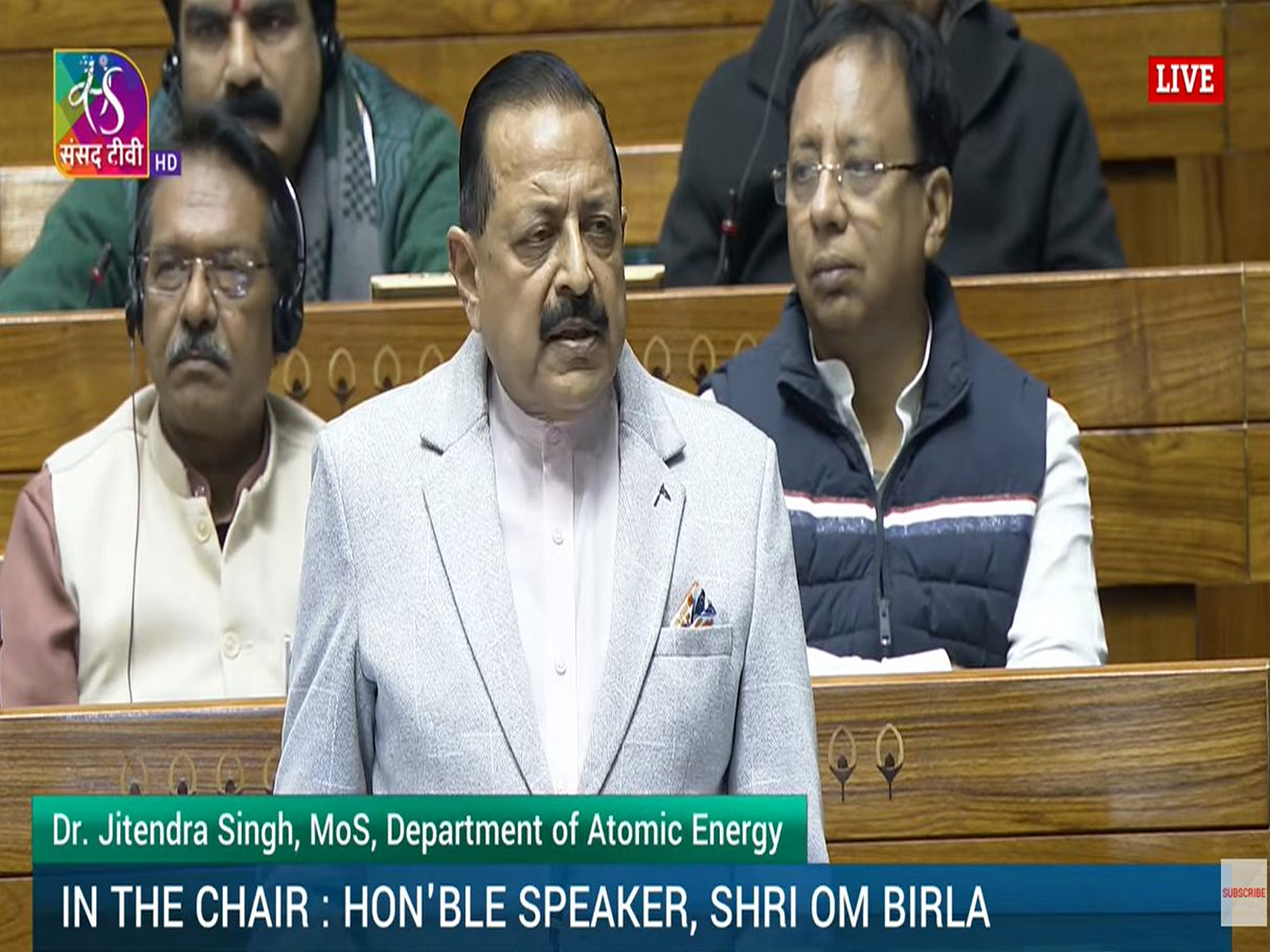

Like the present decision to do away with export duties on steel! So says Vedant Goel, Managing Director of Neo Mega Steel LLP in the backdrop of the recent decrease in export duties by the GOI on steel export as also the concurrent reduction in import duties on anthracite, coking coal and ferronickel.

Increased input costs brought about by high import duties on already high prices of coke, anthracite, PCI, and coking coal, the double whammy came in the form of duties on exports that made Indian steel more expensive in the international markets be it of Europe, US or Africa. The domestic markets suffered a carnage of varied sorts, it was only the export markets which were helping the steel makers of India.

But as promised right when it was first implemented, the GOI has gone ahead with its promise and has brought down export duties. The relaxation pertains to iron ore lumps and fines that have Fe content less than 58 per cent, iron ore pellets, and the specified steel products, including pig iron. What this translates to is that exports of iron ore lumps and fines with Fe content less than 58 per cent will incur no export duties, and otherwise, a 15 per cent duty. Exports of iron ore pellets and pig iron and steel products classified as HS 7201, 7208, 7209, 7210, 7213, 7214, 7219, 7222, and 7227 will be duty-free.

According to Vedant Goel, adding to the cheer is the reduction in import duties on anthracite, PCI, and coking coal, as well as ferronickel, to a 2.5 per cent, and on Coke and Semi-Coke to 5 per cent. Given that Indian steel is affected by the cost of electricity, high coal prices were also affecting prices of final steel products.

Facing tough times due to increased input costs on the one hand and reduced markets on the other, these steps then were much-awaited by the industry for the last six months for better days in the future.

An indicator of the fall-out of the government's earlier decision to tax exports was the distress faced in the last quarter by everyone and most visible in the adverse financials of the likes of Tata Steel, JSW and JSPL.

In days to come, the steps shall have a few positives including:

Making Indian steel competitive in the international markets of Europe that's facing a tough energy crisis due to which their domestic production has turned very uncompetitive. The other markets include the US and Africa, including the Gulf that's on a building spree.

The duty relaxation being under two slabs, the step takes care of the interest of consumers on multiple fronts and markets, domestic or others

Reduction of import duties on anthracite, PCI, and coking coal shall bring down the cost of production of iron and steel production on multiple fronts. First, in the production of iron and steel where these in varied forms find use as a reducing agent, and second, in the production of power where these form the feedstock of power plants, both captive or otherwise.

Reduction of import duties on ferronickel shall have a healthy effect on the production of stainless steel and other downstream products that are finding increasing application within the country.

These, according to Vedant Goel, are the indication of good times that ought to continue long enough for other parts of the economy to pick-up and stabilize.

This story has been provided by ATK. ANI will not be responsible in any way for the content in this article. (ANI/ATK)