Save smartly with the Bajaj Finance Systematic Deposit Plan

Sep 28, 2020

Pune (Maharashtra) [India], September 28 (ANI/NewsVoir): Funding long-term goals requires smart investments. However, most investments warrant a lump sum amount to get started, which is not always possible for individuals living from paycheck to paycheck.

To help such savers build a strong corpus, amid increasing debt and higher cost of living, Bajaj Finance Limited (BFL), the lending and investing arm of Bajaj Finserv, offers the convenience of Systematic Deposit Plan (SDP).

Systematic Deposit Plan combines the convenience of SIPs with the assurance of returns one gets from Fixed Deposit, to enable investors make deposits as low as Rs 5000 per month. Every deposit under Systematic Deposit Plan earns interest, as per the prevailing FD interest rates at the time of deposit. Investing in SDP offered by BFL is an ideal option for investors looking to build their habit of saving. With this plan, investors can choose to grow their corpus as per their choice, by selecting any of the variants offered under SDP.

Monthly Maturity Scheme - Under this scheme, investors can invest in 6 to 48 deposits. They can select any tenure ranging from 12 to 60 months for each deposit. The tenure they select gets applied to all the deposits they invest in. On maturity, the interest earned for every deposit is received in a series of months, when the deposit(s) mature as per the chosen tenure.

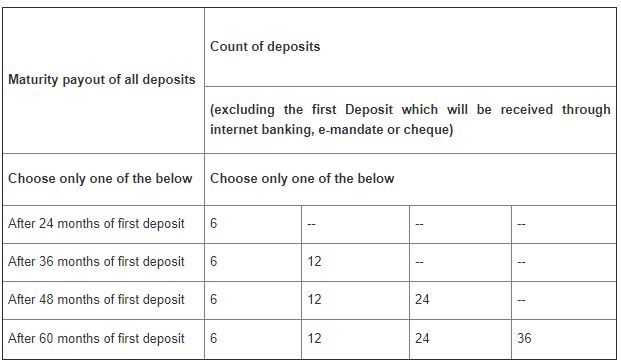

Single Maturity Scheme - Under this newly introduced variant, investors can start small deposits on a monthly basis, but they receive their maturity proceeds as a lumpsump on a single day. To save with Single Maturity Scheme, investors can choose the tenure and number of deposits as per the below grid -

Note: Deposits made under the Single Maturity Scheme cannot be renewed, and there is a common application form for both schemes.

Aside from these two variants, the Systematic Deposit Plan has as host of other benefits to offer such as:

Convenient savings

Saving with a Single Maturity Scheme is simple, as investors can choose to make their monthly deposits on 3rd, 7th or 12th of each month. However, the date once chosen, remains fixed for rest of the deposits. The payment for the first deposit needs to be made by cheque or online, which enables the registration of the depositor's bank account with Bajaj Finance Limited. All the subsequent payments for deposits then get deducted from the depositors' bank account through the NACH mandate.

Additionally, for those looking to plan and calculate their investments in advance, Bajaj Finance FD return calculator can be a great tool. Investors can also compare the returns on Fixed Deposit and Systematic Deposit Plan to determine the growth of their savings.

Safety of deposit

The company understands how important safety is for any investor especially during such times of uncertainty. However, by choosing to invest in the Bajaj Finance FD investors can be assured of maximum safety and low risk on their investments as the company's Fixed Deposit is accredited with the highest safety ratings of FAAA by CRISIL and MAAA by ICRA.

Pre-mature withdrawal

Premature withdrawal is permitted for either one or more deposit(s) under SDP, provided the FD has completed more than 3 months from the date of its issuance.

Note - Current RBI regulations on premature withdrawal will be applicable.

To invest under the SDP with the company, the investor needs to submit the following documents:

* PAN Card

* Driver's License/Voter's ID/ Passport/Aadhaar Card/NREGA job card

* Latest photograph

* NACH Mandate

* Account payee cheque

In addition one needs to simply fill the online application form and an authorised representative will get in touch to complete all formalities.

The company also offers flexibility to the investors if they choose to cancel or stop their SDP. All they need to do is simply cancel their NACH mandate anytime to stop the plan.

Note - Bounce charges may be levied by the Bank of the depositor for NACH dishonour and in that case BFL will not be held responsible.

These flexible features make Bajaj Finance a great choice for those looking for rewarding investments and to build the habit of saving. In addition to attractive FD interest rates, Bajaj Finance offers easy online FD facilities and the convenience of customizing investments as per investors' choice. With a deposit book of more than Rs 20,000 crores and 2,35,000 FD customers, this is a great option for those looking to put their money to work for them.

Bajaj Finance Limited, the lending company of Bajaj Finserv group, is one of the most diversified NBFCs in the Indian market catering to more than 40 million customers across the country. Headquartered in Pune, the company's product offering includes Consumer Durable Loans, Lifestyle Finance, Lifecare Finance, Digital Product Finance, Personal Loans, Loan against Property, Small Business Loans, Home loans, Credit Cards, Two-wheeler and Three-wheeler Loans, Commercial lending/SME Loans, Loan against Securities and Rural Finance which includes Gold Loans and Vehicle Refinancing Loans along with Fixed Deposits. Bajaj Finance Limited prides itself on holding the highest credit rating of FAAA/Stable for any NBFC in the country today.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)