SC to examine Shylockian attitudes over money lendings

Jul 26, 2024

New Delhi [India], July 26 : The Supreme Court has agreed to examine the issue of lenders adopting Shylockian attitudes and has stated that it will regulate such instances to rescue borrowers who are trapped in debt.

A bench comprising Justices CT Ravikumar and Sanjay Karol noted that they have encountered cases where so-called friendly advances amount to crores of rupees.

"We are deeply concerned and pained by instances where ordinary laymen take such loans and are eventually driven to the streets or even to commit suicide due to lenders adopting Shylockian attitudes," the court said. It agreed to regulate such instances and rescue the hapless borrowers doomed to debt.

Shylock is a character in The Merchant of Venice, one of Shakespeare's greatest dramatic creations.

"Shylockian attitudes without shame continue in such instances, and more often than not, despite repaying the amount actually advanced, the borrower is forced to pay double the amount or more in interest," the top court said.

"To avoid falling under the purview of money lending business laws, some lenders prudently (or cunningly?) avoid continuous transactions and give large loans intermittently, only for interest. In the case at hand, the respondent claims to have advanced loans to the petitioner totaling Rs. 85 lakhs on different dates and in different modes as friendly loans," the top court said.

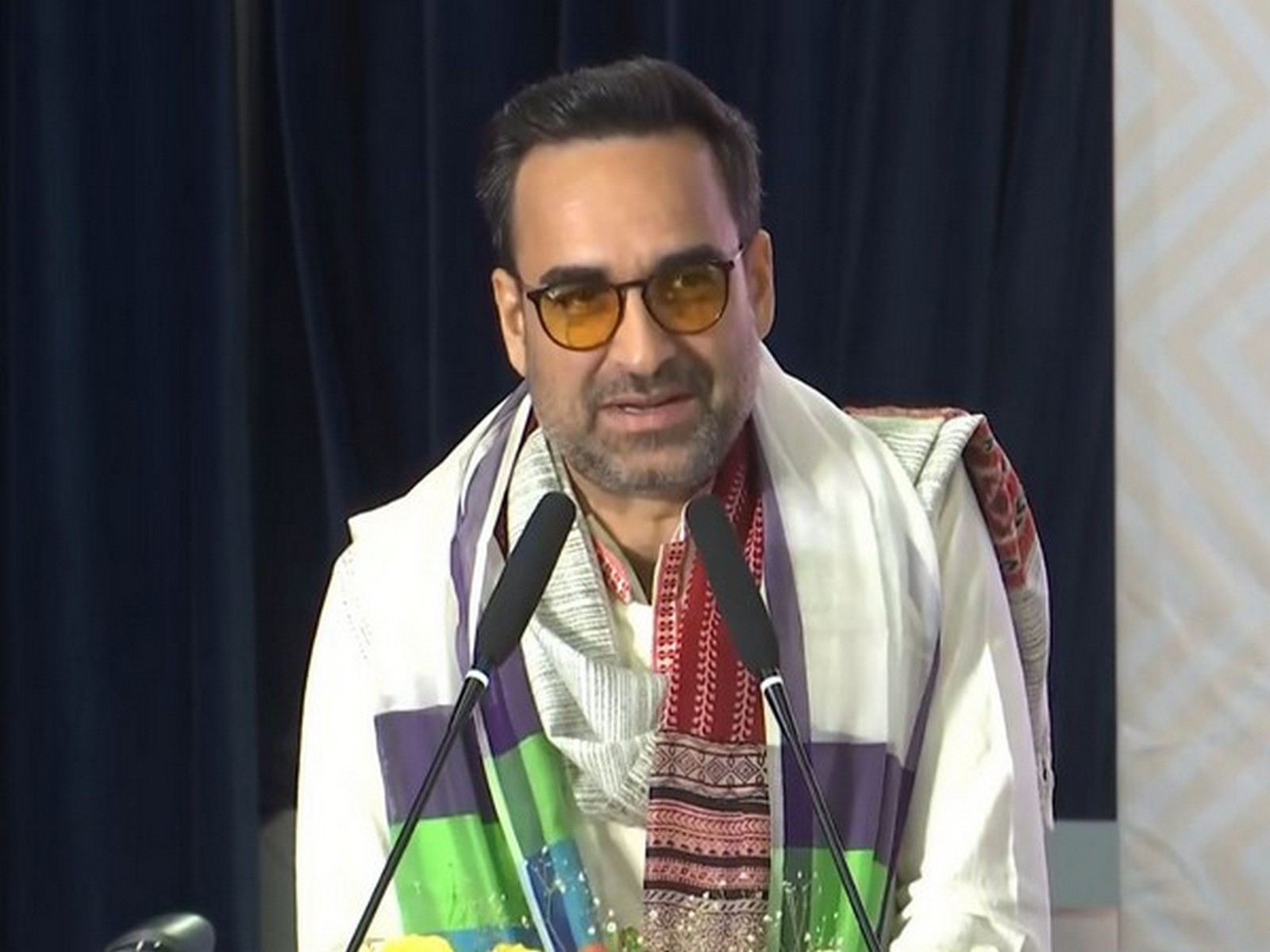

The court's observation came while dealing with a cheque bounce dispute involving Bollywood filmmaker Raj Kumar Santoshi.

The court stated that it has taken this extraordinary step due to the growing menace to society.

"Lending money on interest without a license, and securing such loans with cheques or property title deeds, essentially partakes the character of a money lending business," the court said.

The court suo motu impleaded the Union of India and the NCT of Delhi, represented by its Chief Secretary, as parties to these proceedings and issued a notice. The court listed the matter for August 23.

The top court noted that in cases involving large amounts, such as Rs. 50 lakhs or more, besides circumventing the provisions of money lending laws, there may also be significant tax evasion involved.

The court further stated that the definition under the Punjab Registration of Money Lenders Act, 1938 (for short 'the Act') does not include instances of lending money for interest secured by cheques or property title deeds within the scope of money lending business. In other words, for such actions to constitute a business, the person concerned must have been effecting continuous transactions of this nature, the top court said.