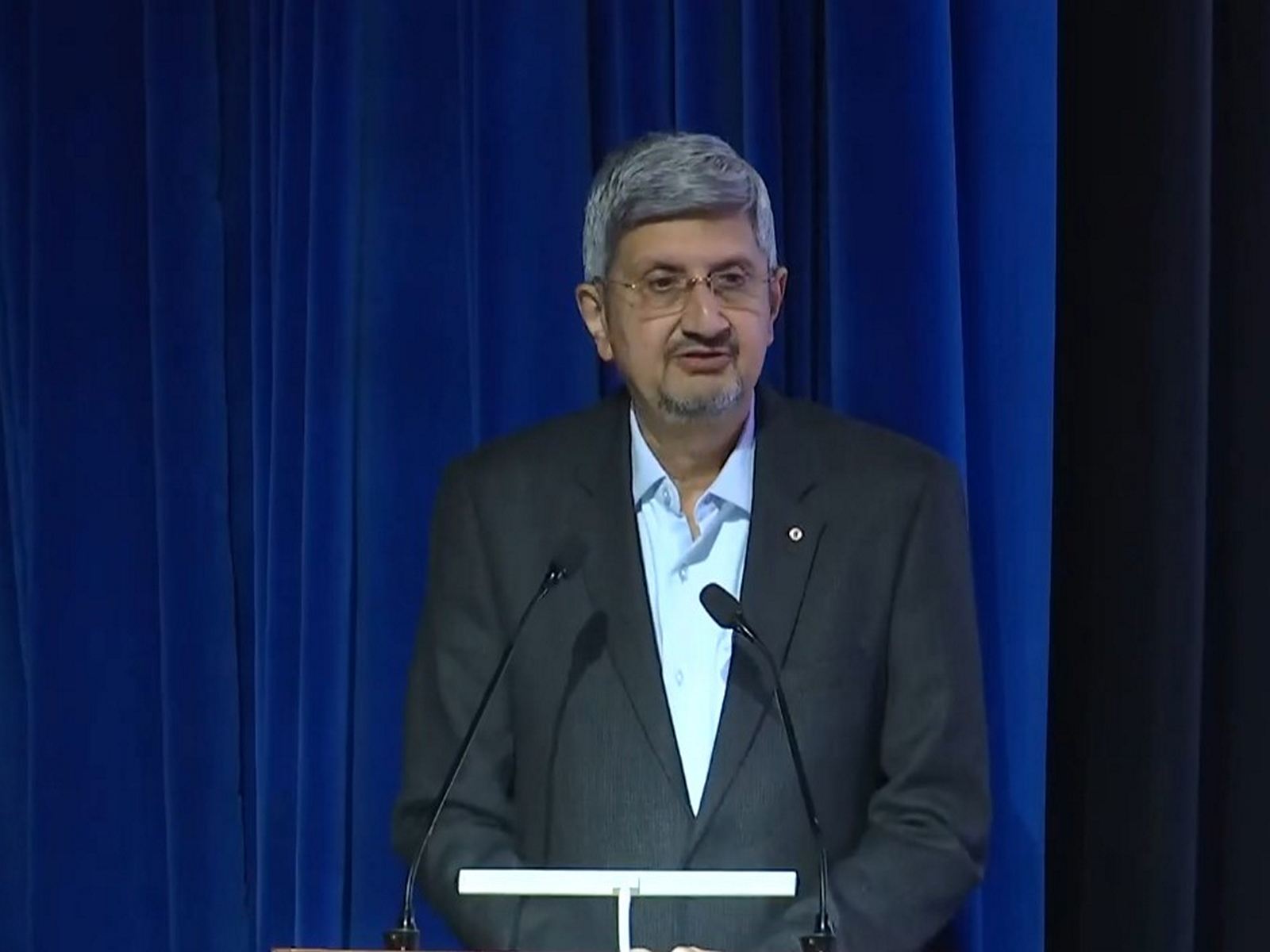

SEBI bars Anil Ambani, Reliance Home Finance from securities market

Feb 11, 2022

Mumbai (Maharashtra) [India], February 12 : Stock market regulator Securities and Exchange Board of India (SEBI) restrained Reliance Home Finance, it's promotor Anil Ambani and three others from buying, selling or dealing in securities, either directly or indirectly, in any manner whatsoever until further orders.

Anil Ambani and others are also restrained from associating themselves with any intermediary registered with SEBI, any listed public company or acting as Directors/promoters of any public company which intends to raise money from the public, till further orders, SEBI said in its interim order issued on Friday late evening.

Interim order issued by S K Mohanty, Whole Time Member of SEBI says that the root of the present proceedings can be traced to multiple sources inter alia, a letter of Price Waterhouse & Co. ("PWC") addressed to Reliance Home Finance Limited (RHFL) intimating their resignation as the Statutory Auditor of the Company citing various grounds & reasons.

Certain complaints received by Securities and Exchange Board of India alleging siphoning off/diversion of funds of RHFL by promoters and management of the Company and also receipt of multiple Fraud Monitoring Returns (FMRs) from Banks alleging, therein amongst others, that funds borrowed by RHFL from different lenders were partly used towards repayment of loans etc.

It was also complained that various, connected parties and companies with weak financials were used as conduits to siphon off funds from RHFL to entities connected to the promoter company viz., Reliance Capital Limited. Interim order says that based on the aforesaid complaints, an investigation was undertaken by SEBI for the period of FY 2018-19. The focus of the said investigation was broadly to investigate into the manner in which the loans were disbursed by RHFL during the period of 2018-19 to several borrowing entities, so as to ascertain if any provision of Securities and Exchange Board of India Act, 1992, Securities Contracts (Regulation) Act, 1956, Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("LODR Regulations/SEBI (LODR Regulations)"), Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices) Regulations, 2003 have been violated.

Interim order stated that Anil Ambani, Reliance Home Finance and others are further called upon to show cause as to why inquiry should not be held against them in terms of Rule 4 of SEBI and penalty be not imposed on them under Section 11 (4A), 11 B (2) read with Section 15HA and/or 15HB of the SEBI Act, 1992 for the above alleged violations of provisions of SEBI Act, 1992, LODR Regulations and PFUTP Regulations. SEBI has given time to Anil Ambani and others of 21 days from the date of receipt of the order to file their reply/objections, if any, and may also indicate whether they desire to avail an opportunity of personal hearing on a date and time to be fixed in that regard.

The above directions shall take effect immediately and shall be in force until further orders.