Second Covid wave to delay full recovery for apparel players to FY23: ICRA

Apr 21, 2021

New Delhi [India], Apr 21 : Investment information firm ICRA expects full recovery for Indian apparel players to be prolonged and pushed back to FY2023, given the resurgence of Covid cases in India and some of the key export markets.

Their business performance in FY2022, however, is expected to be better than FY2021, supported by continued favourable progress on the vaccination rollout and a material shift witnessed towards online shopping.

This will cushion the adverse impact on the brick-and-mortar outlets, helping companies report a better performance vis-a-vis last year.

Besides, lockdown restrictions are likely to be more targeted and regionally focused vis-a-vis the national lockdown implemented last year, and companies are better prepared to follow protocols, respond to restrictions and minimise loss of operations.

ICRA projects the Indian apparel companies to report double-digit growth in FY2022 albeit on a low base, achieving 85 to 95 per cent of the pre-Covid turnover levels, broadly maintaining the level of recovery achieved in H2 FY2021.

Besides pent-up and festive demand, which temporarily supported demand during Q3 FY2021, increased mobility amid the easing of the lockdowns increased consumer confidence in H2 FY2021.

This encouraged higher footfalls in marketplaces and drove discretionary consumer spending.

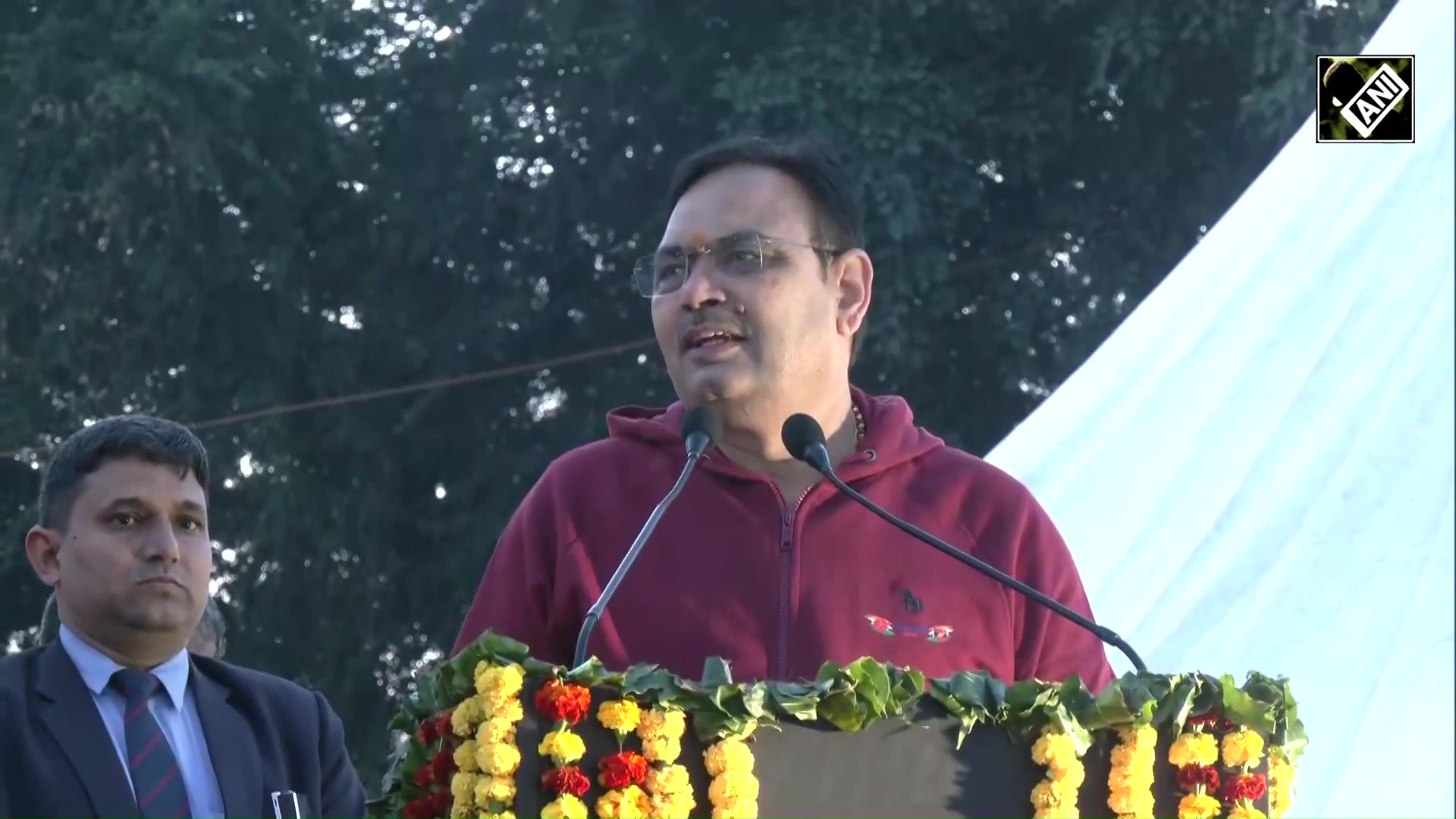

Jayanta Roy, Senior Vice President and Group Head for Corporate Sector Ratings at ICRA, said the trend seen in FY2021 is corroborated from the rating movements as well.

"While the credit ratio (ratio of upgrades to downgrades) for apparel companies remained at less than 1 in FY2021, reflecting a weakening of credit profiles amid Covid-19 induced challenges, nearly two-thirds of the downgrades happened in the initial seven months of FY2021, with downgrade pressures subsiding significantly from November 2020 onwards."

In FY2021, apparel exporters in ICRA's sample are estimated to have reported a 20 to 25 per cent decline in turnover, and a 50 to 75 basis points (bps) decline in operating margins, following a 200-bps decline in FY2020 owing to a revision in export incentive rates and a Covid-led slowdown witnessed from Q4 FY2020 onwards.

For FY2022, ICRA expects top-line growth of 15 to 20 per cent for apparel exporters with range-bound margins amid continued discounting requirements, volatile demand patterns and intense competition in the global apparel markets.

Apparel retailers are expected to report a 35 to 40 per cent growth in turnover in FY2022 with partial recovery in operating margins. However, margins are expected to remain lower than the pre-Covid levels by 200 to 300 bps.

Domestic apparel retailers are estimated to have witnessed 35 to 40 per cent decline in turnover and a sharp contraction of 400 to 500 bps in their operating margins in FY2021, with steep discounts to liquidate channel inventories and high fixed costs like rentals and sales force despite steps taken to curtail these costs.

For FY2022, apart from these continued pressures, increased raw material costs are likely to limit improvement in margins for apparel players.

There has been a sharp surge in yarn prices across the board. In March, cotton, polyester and viscose yarn prices averaged 21 to 22 per cent higher than the level seen about three months ago, and 40 per cent, 26 per cent and 19 per cent higher respectively than the average level in March 2020.