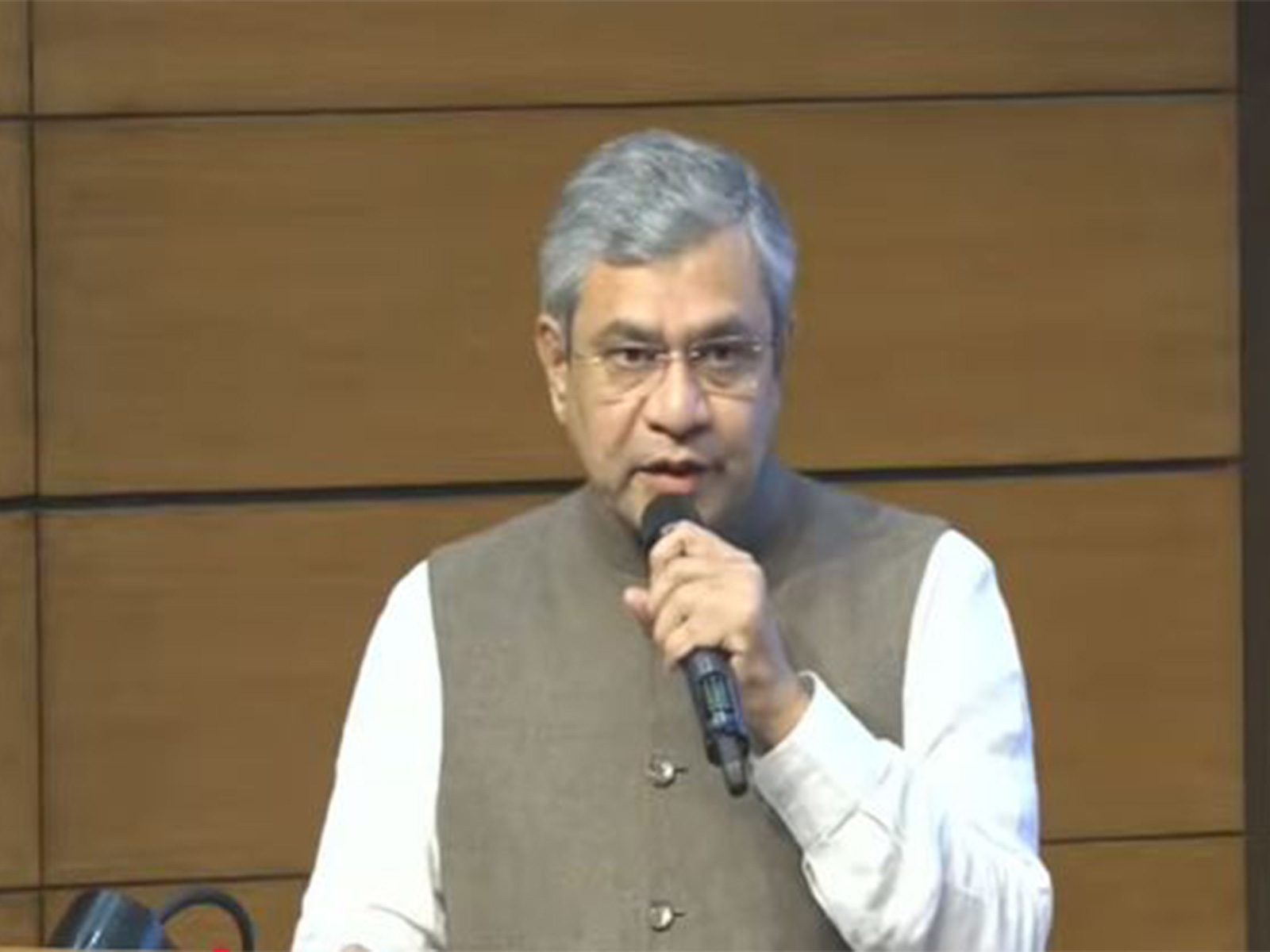

Simplified capital gain tax rates for better public understanding, says Revenue Secretary Sanjay Malhotra

Jul 24, 2024

New Delhi [India], July 24 : The changes in the capital gain taxes have been announced to make the rates simple to understand people so that they can understand their tax rates well, said Revenue Secretary, Sanjay Malhotra.

"Our intention is to make it simple, and reasonable," Malhotra told ANI, reacting to the announcements.

As part of the Union Budget, Finance Minister Nirmala Sitharaman announced that short-term gains on certain financial assets attract a tax rate of 20 per cent, while that on all other financial assets and all non-financial assets shall continue to attract the applicable tax rate.

The Finance Minister proposed that the long-term gains on all financial and non-financial assets will attract a tax rate of 12.5 per cent. For the benefit of the lower and middle-income classes, she proposed to increase the limit on the exemption of capital gains on certain financial assets from Rs 1 lakh to Rs 1.25 lakh per year.

According to the announcements, listed financial assets held for more than a year will be classified as long-term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term.

While unlisted bonds and debentures, debt mutual funds, and market-linked debentures, irrespective of the holding period, will attract tax on capital gains at applicable rates.

The Revenue Secretary said that the rates earlier were very complicated to understand for the people. "Somewhere it was 20 per cent with indexation, somewhere it was 10 per cent, somewhere the holding period is 1 year, somewhere it is 2 years, somewhere it is 3 years. So, these permutation combinations are very simple. For one long-term gain, 12.5 per cent was done. In the holding period also, simplification was done for 1 year and 2 years," he added.

"We have estimated that if the return is around 10 per cent, then in today's day and age, The rate of tax will be the same," the Revenue Secretary said.

Revenue Secretary also hailed the announcements made for the Ministry of Micro, Small and Medium Enterprises

(MSMEs) sector.

"Through the boost given to employment, I think this is the cornerstone of the budget along with micro small medium enterprises energy security and I think employment and skilling are the very big cornerstones of the budget," he added.

Commenting on the employment and job creation as announced in the Union Budget, he highlighted that the announcements show the strong intention of the government to reap the benefit of the demographic dividend. "It is a very strong statement from the government that it understands the importance of reaping the demographic dividend and some of the conditions attached to the first-time job seekers to benefit from the subsidy that the government will be giving are also very important."

This year, Rs 1.48 lakh crore is earmarked for education, employment, and skill development.

In addition, the government will introduce three 'Employment Linked Incentive' schemes under the Prime Minister's package, targeting EPFO enrolment, first-time employee recognition, and support for both employees and employers.