Stock market ends in red amid muted trading start; Sensex and Nifty record declines

Feb 05, 2024

Mumbai (Maharashtra) [India], February 5 : The stock market witnessed a downward trend today, closing in the red after a relatively muted start to the trading session. The benchmark indices, Sensex and Nifty, faced declines, reflecting the cautious sentiment prevailing in the market.

The BSE Sensex, a 30-share benchmark index, concluded the day at 71,731.42, marking a decline of 354.21 points, equivalent to a 0.49 per cent decrease.

Simultaneously, the NSE Nifty closed at 21,771.70, down by 82.10 points, representing a 0.38 per cent decline.

The Nifty Bank observed a 0.32 per cent dip, settling at 45,825.55.

Among the Nifty companies, 25 experienced advances, while 23 faced declines. Noteworthy gainers included Tata Motors, Coal India, BPCL, Sun Pharma, and Cipla, contributing positively to the market sentiment. On the other side, UPL, Bajaj Finance, Bharti Airtel, HDFC Life, and Grasim were among the top losers at the market closing.

In the Sensex, key gainers encompassed Tata Motors, Sun Pharma, PowerGrid, M&M, and Tata Steel. Conversely, Bajaj Finance, Bharti Airtel, Maruti, Bajaj Finserv, and HCL Tech faced declines, impacting the overall index performance.

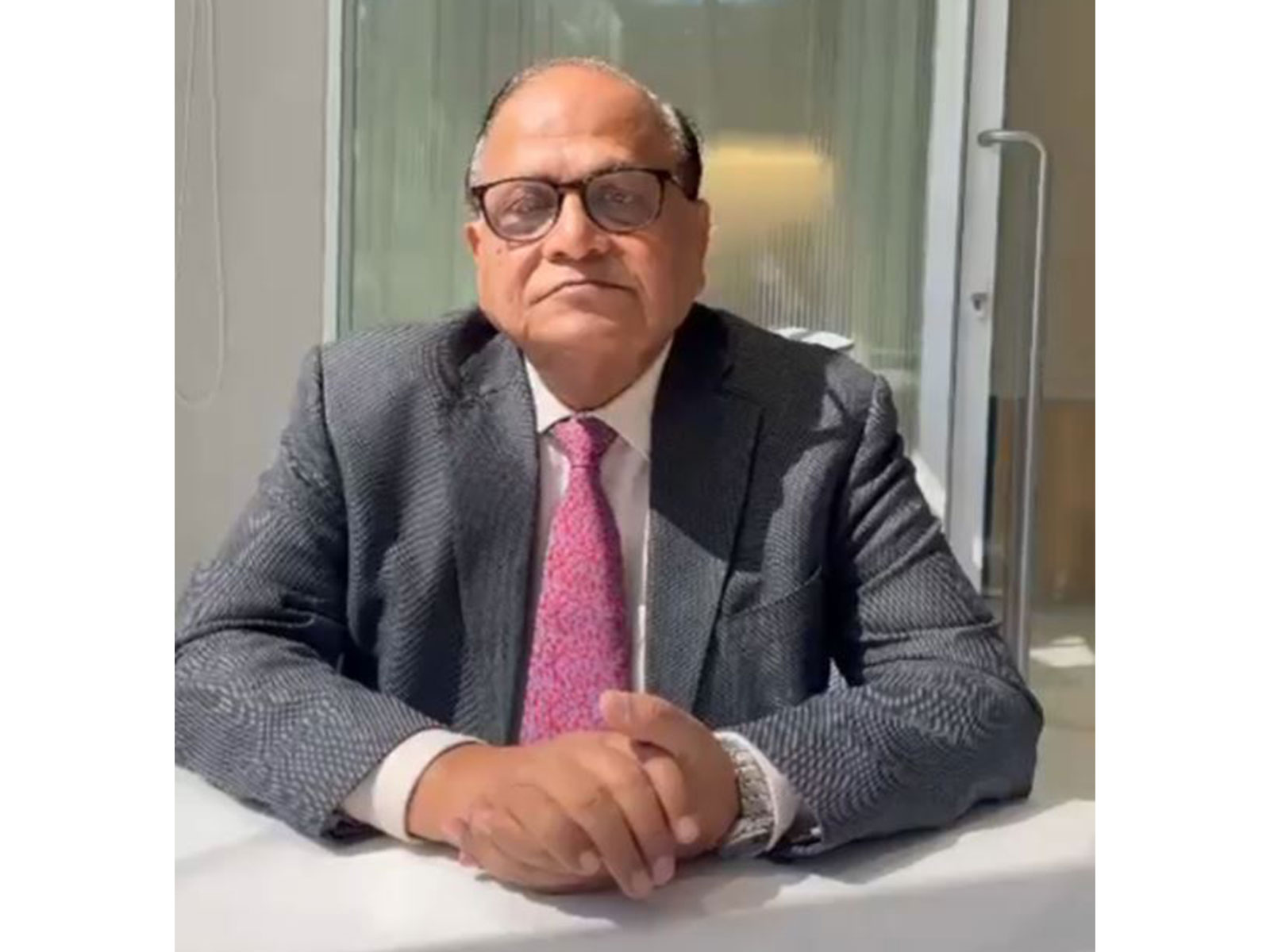

Varun Aggarwal, founder and managing director, Profit Idea, said, "The sectoral indices, including Consumer Durables, Financial Services, FMCG, and Banks, recorded losses, adding to the overall negative sentiment in the market. Meanwhile, in European markets, the Stoxx 600 Index rose by 0.2 per cent, following Wall Street's record close. However, Asian stocks faced declines, particularly in Chinese shares, despite regulatory assurances."

The Shenzhen market initially witnessed a significant drop of 4.4 per cent but later recovered to close 1.1 per cent lower. Similarly, the Shanghai Composite slipped 3.5 per cent, ultimately closing 1 per cent lower at 2,702.19.

On the currency front, the dollar reached a two-month high against major peers on Monday. This boost was attributed to a robust U.S. jobs report, prompting a reconsideration of aggressive rate cut expectations.

Federal Reserve Chair Jerome Powell suggested a cautious approach to rate cuts, leading to a further rise in Treasury yields. USDINR Futures were traded at Rs 83.080.

Notably, on Friday, the market had experienced an upward surge of over 500 points following the central government's Budget announcement.

The budget showcased the government's intent for fiscal consolidation, even as general elections loom on the horizon.

The contrasting trends between Friday's optimism and today's cautious approach underscore the dynamic nature of the stock market influenced by various economic factors and global events.