"SVB failure puts a question mark on framework of American banking system towards startups"

Mar 16, 2023

By Shailesh Yadav

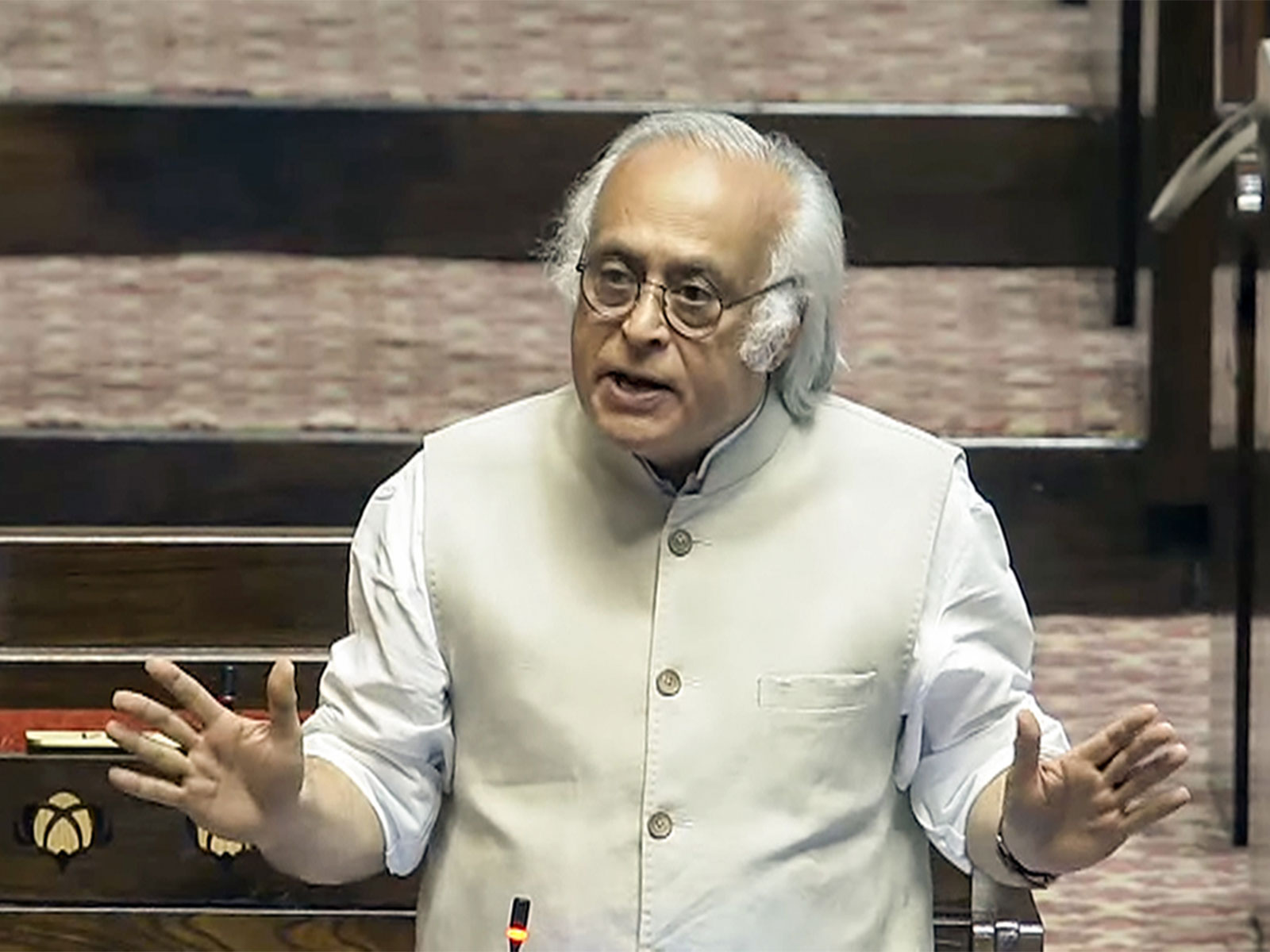

New Delhi [India], March 16 : Silicon Valley Bank (SVB) is one of the oldest and the most fundamental banks that was helping startups keep their money, Saket Dalmia, President, PHD Chambers and Commerce and Industry said on Thursday. He said the failure of SVB brings into focus the entire framework of the American banking system towards startups.

"It's a huge shock, but at the same time, a huge opportunity, I think, for Indian ecosystem, to have its own bank for the money which is being used by Indian startups to be in India," said Saket Dalmia, President, PHD Chambers and Commerce and Industry.

Dalmia said that he had a conversation with Rajiv Chandrasekhar, Minister of State for Electronics and Information Technology. "We had 450 people from our domain, having a large conversation with Minister on Tuesday and he assured us that whatever can be done will be done," he added.

Talking to ANI Sandeep Naik, Managing Director, General Atlantic, India said that this is the one volatility that is entered into the market when it comes to India and Indian companies. I think we are reasonably isolated from that. So far our Indian entrepreneurs in the tech ecosystem, they don't see much impact of what's happening.

US regulators on Friday (local time) shut down Silicon Valley Bank, as markets fretted over possible contagion from the biggest banking failure since the 2008 financial crisis.

California regulators closed down the tech lender and put it under the control of the US Federal Deposit Insurance Corporation (FDIC).

The FDIC is acting as a receiver, which typically means it will liquidate the bank's assets to pay back its customers, including depositors and creditors.

Silicon Valley Bank collapsed after a stunning 48 hours in which a bank run and a capital crisis led to the second-largest failure of a financial institution in US history.

All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023, read FDIC statement.