Unfair Trade Practices by Large Online Travel Agents Could Lead to a Loss of 15,000 Jobs and Closure of More Than 1,000 Hotels

Dec 11, 2020

New Delhi [India], December 11 (ANI/BusinessWire India): In March 2020, FAITH (Federation of Associations in Tourism & Hospitality) projected for the first time that India's hospitality industry is staring at losses of Rs. 5 lacs crores due to COVID-19. Within the next 4 months by July 2020, as lockdowns extended multiple times, this estimate was revised to Rs. 15 lac crores (approx. 75% of India's annual tourism GDP). It would not be unreasonable to expect that in these times of unprecedented and exceptional crisis, in which hospitality industry has been one of the worst hit sectors, large travel industry players would extend their full co-operation to smaller players for the sheer sake of preserving the entire Indian travel ecosystem.

What we are witnessing today though goes against any test of reasonability or fairness. In an on-going investigation case in front of Competition Commission of India (CCI), two players of the hotel industry, FabHotels and Treebo, are arguing for reversal of their unjust and illegal exclusion from the largest OTA platforms in India, MakeMyTrip and Goibibo (both owned by MakeMyTrip, MMYT). In Case 14 of 2019, in a prima facie order passed on 28.10.2019, honorable CCI stated that if exclusion of FabHotels and Treebo from MMYT platforms was a result of agreement between MMT and Oyo, it would contravene section 3(4) of the Competition Act. Our well-placed sources also contend that any discriminatory and preferential treatment by a dominant player (such as MMYT) to some specific player(s) would also violate section 4(2) of the Act.

Any regular user of budget hotels would argue and agree with the statement that the customer experience in this low-end segment is a large problem and badly affected by problems of hygiene and lack of any modicum of staff courtesy at these hotels. In a developing country like India where a large segment of travellers are middle-class and can't afford to stay in luxury hotels, more and more players should be encouraged to offer their services to such travellers. A large player such as MakeMyTrip with a market share of more than 70% as per many industry sources, has a responsibility on its shoulders to offer level-playing field to all budget hotel brands, be it large or small. Young budding entrepreneurs today look up to the MMYT brand, for the success it has achieved and how it is the only brand to successfully list on the US stock markets. The seemingly short-sighted behaviour on the other side in the market does not bode well for the oldest internet brand of India.

MakeMyTrip today is 53% owned by a Chinese travel player, Ctrip (as per regulatory submissions, 49% is owned directly by Ctrip while remaining 4% is held in a third-party entity known as Golden Trip Investment Fund LP). Even 5 of the directors on a 10-member board of MakeMyTrip seem to be nominated by China's Ctrip. In an increasingly complex geo-political equation with China, the expectation from such a player would be to not entangle itself in legal misadventures in the domestic market and operate as per the extant laws of the country. It would not also be out of place here to mention that Trump administration in US, earlier this year, ordered Shiji Group, a Chinese hotel tech player, to unwind its acquisition of a US-based player due to a "threat to impair the national security of the United States". The concern was Chinese access to critical data of millions of US travellers, which could be used to influence US internal matters.

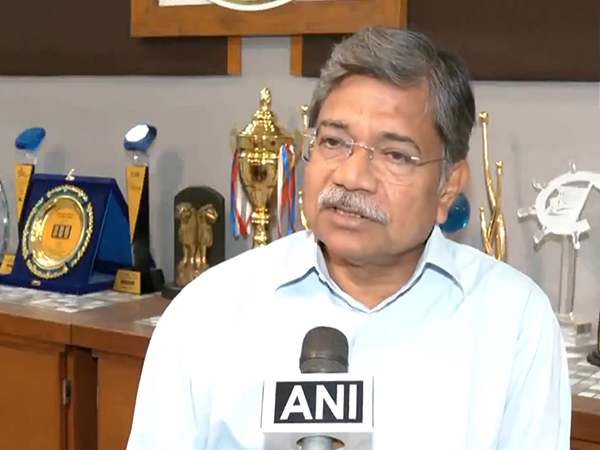

This is what RikantPittie, Cofounder and COO at EaseMyTrip had to say on the matter, "We believe India requires better regulation in online markets, similar to what exists in ecommerce. Especially to enable faster recovery of home-grown travel companies from COVID and to avoid colonisation of Indian markets from foreign-funded players, it's critical that there is a level playing field and larger players are not allowed to grow at direct expense of emerging startups."

Coming back to the investigation currently underway in CCI, I expect that players such as FabHotels and Treebo which were trying to build a product to actually solve the problems so prevalent in the budget hotel market might go out of business soon if they are not allowed to list back on MMYT platforms. Treebo has managed to raise only Rs. 10 cr recently (compared to Rs. 7500 crore in banks of Oyo as reported publicly). With such a thin thread that is holding these players in place, it may not be very late that the thread breaks loose, taking down with it all the hoteliers who depend on these brands for their daily livelihood and all the employees who are employed with these companies and their partner hotels. Such an event would be a disaster that would deal a blow to the already struggling Covid-stuck economy and take unemployment even higher. As they say, with great power comes great responsibility. Large OTAs would do well to heed to this advice now.

This story is provided by BusinessWire India. ANI will not be responsible in any way for the content of this article. (ANI/BusinessWire India)