What stock exchanges do to check undesirable activities, keep sanctity of market

Apr 06, 2024

By Animesh Deb

Mumbai (Maharashtra) [India], April 6 : Shares of thousands of companies trade on stock exchanges and it needs close monitoring as people's hard-earned money is at stake.

It is humanely impossible to track the entire market on a real-time basis. So, how do the exchanges keep a tab on the movement of scrips and indices and contracts so that undesirable practices, if any, can be stopped?

There are several instances when rumours or unverified news float about companies on various social media platforms, which invariably has the potential to affect the prices of those companies' shares.

A growing number of Indians, mostly youth, are reaping dividends from India's growing financial markets, and it is critical to have a robust regulatory mechanism.

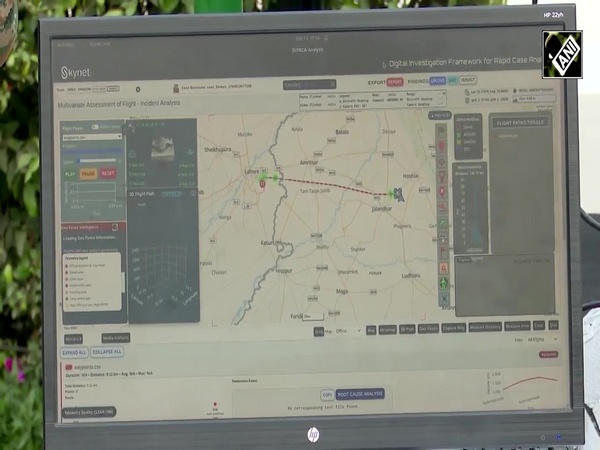

An exchange scrapes through websites and social media platforms to see if any unverified news is floating and is influencing certain specific stocks, officials at NSE told a delegation of journalists.

"We try to judge whether the market movement is reasonable or unreasonable, and obviously the judgement is subjective. We have the proper process to analyse," an official explained.

As per Listing Obligations and Disclosure Requirements (LODR), the listed companies should first inform any new information about the company to the exchanges and subsequently it is the exchanges' job to make them available for public consumption.

Exchanges keep track on whether any news items are floating which are not disclosed by the respective companies. Also, they check if any investors are investing based on those unverified news items.

In case the news is unverified, exchanges typically write to the company asking to confirm or deny the news items.

Financial markets regulator SEBI had in January this year asked the top 100 listed companies by market capitalization (size) effective from June 1, 2024, to verify and confirm, deny or clarify in case of any market rumours.

For the top 250 listed entities, it will come into effect from December 1, 2024. This move is to bring more transparency and to ensure timely disclosure of material events or information by listed entities.

Further, as part of surveillance mechanisms, an exchange in India, as per the laid out guidelines of the regulator Securities and Exchange Board of India (SEBI), can also put a cap or limit on shares, contracts, or index on any given day. For derivatives, it has the power to slow their movement.

SEBI and exchanges, in order to enhance market integrity and safeguard interest of investors, have been introducing various pre-emptive surveillance measures.

Exchanges can restrict prices of shares in terms of percentage it can move on either side, which is called circuits. Objectives are to restrict buying/selling at unwanted prices and to restrict massive buying/selling based on unverified news. Circuit is the highest or lowest possible price that the stock of a firm can trade at on a particular day.

Normally, for any scrip that is not under any surveillance, the circuit is 20 per cent. As and when its fundamentals weaken or there is large volatility it can be brought down to 5 per cent. Cooling time is then kept to provide investors time to think about their investment decisions and not make haphazard moves.

Exchanges have no discretion, they just follow the rules mandated by the regulator SEBI.

For those shares whose fundamentals are not strong, exchanges cannot ban trading on these but they provide maximum actionable information to the investor community to help make informed judgements.

Many brokerages also push messages to investors through pop-ups if they go for investments in such fundamentally weak companies. There are various kinds of alerts to keep investors informed.

In the harshest of actions where there is high volatility, exchanges can even restrict trading of a particular share to only once a week. In extreme cases, exchanges can ask investors to deposit a matching amount to that of shares bought in order to discourage investments in high-risk stocks.

What can people do in case they receive unsolicited calls or SMSes making unreasonable promises? They can report to the exchanges.