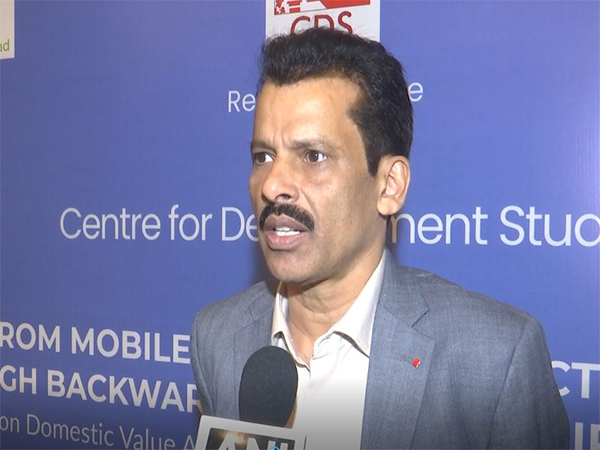

With clean balance-sheet Indian Banking sector has enough opportunity for growth: K V Kamath

May 17, 2024

New Delhi [India], May 17 : India's banking sector is ready and fit to support the growth of India in the coming years highlights KV Kamath, Chairman, National Bank for Financing Infrastructure & Development in an interview with ANI.

He also pointed out that after the government has solved the problems of NPA (Non-Performing Asset) in India and India's banking sector has come out of the twin balance sheet problem so now the banking sector is ready to support the growth of the country.

"I think the Indian banking sector is fit and ready to see India at the next level, the growth that we are having. And I think we are well equipped to support that growth" he said.

During the conversation with ANI, he also shared that the manufacturing sector in India will also rise on its own if the country continues its economic growth at a rate of more than 7 per cent yearly.

"If India grows at 7-7.5 per cent, manufacturing will happen on its own. It will happen on its own" he said.

He further added, "I look at all that has been done, the clean balance sheets, the opportunities before them, the growth that we see, the Indian economy should do extremely well".

The issue of Non-Performing Assets has been a significant problem for banks for a long time but the government and RBI through the Insolvency and Bankruptcy Code, of 2016 have reduced the number of NPAs in India.

Earlier the Indian banks were suffering from a twin balance sheet problem where the banks' balance sheets were affected because of the rising bad loans and the corporate balance sheets were affected by the situation of non-payment of dues and rising loans.

Finance Minister Nirmala Sitharaman also said "RBI and government survey report said from those twin balance sheet problems of 2013-14 today it is twin balance sheet advantage situation. So both corporate and financial sector balance sheets have not just turned around but are in pink to help".

Public sector banks in India are doing better in comparison to their private sector counterparts in terms of non-performing assets, a survey conducted by industry body FICCI and the banking association Indian Banks' Association (IBA) found.

According to the survey, a large majority (77 per cent) of the respondent banks reported a decrease in the NPA levels in the last six months. All responding public sector banks have cited a reduction in NPA levels, while amongst participating private sector banks, 67 per cent of banks have cited a decrease.

None of the respondent public sector banks and foreign banks have stated an increase in their NPA levels over the last six months while 22 per cent of private banks reported an increase.

Among the sectors that continue to show high levels of NPAs, most of the participating bankers identified sectors such as food processing, textiles, and infrastructure.