WWB, Bank of Baroda report recommends 'Jan Dhan Plus' to catalyse formal savings behaviour

Aug 19, 2021

New Delhi [India], August 19 : Public sector banks can attract about Rs 25,000 crore in deposits by serving 100 million low-income women while financially empowering 40 crore Indians, according to a new report published jointly by Bank of Baroda and global non-profit organisation Women's World Banking.

The report titled 'The Power of Jan Dhan: Making Finance Work for Women in India' provides in-depth insights into savings behaviour and financial inclusion barriers of women.

It underscores the need for sex-disaggregated data to design products for women that make them confident and comfortable in engaging with banks.

The report also provides recommendations to PSBs and policymakers to successfully empower account-holders of Pradhan Mantri Jan Dhan Yojana (PMJDY), the government's flagship financial inclusion scheme launched in 2014.

Women's World Banking and Bank of Baroda have designed 'Jan Dhan Plus' a pilot product that seeks to encourage greater account usage among women Jan Dhan customers which combines a Jan Dhan account with an incentive to deposit Rs 500 over four months.

In return, the account holder receives a Rs 10,000 credit or overdraft facility.

This has several benefits, the report says. Women account holders engage more with banks and build skills and trust while the bank learns more about an important customer base and how to address it with products and services.

Women and their households not only develop a body of savings to support them in times of economic hardships such as Covid-19, but they also have access to an overdraft facility, providing both an emergency fund, and a credit footprint for them to potentially access loans and other services in the future.

According to the report, the pilot of Jan Dhan Plus was conducted with 101 Bank of Baroda branches across Mumbai, Delhi, and Chennai and over 300 business correspondent points between February to August 2020.

During this period, nearly 50,000 men and women customers signed up for Jan Dhan Plus. About 32 per cent of women who visited the business correspondent points enrolled in the scheme within the first two months of the launch.

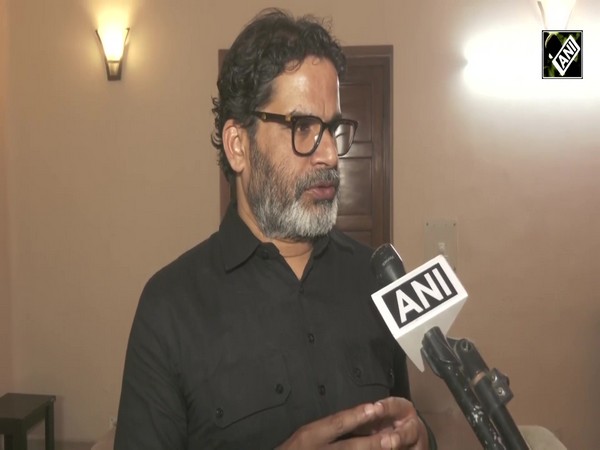

"Women's financial inclusion requires a more gender-inclusive financial system that addresses the specific demand and supply side barriers women face and leverages a partnership-led approach to address existing gaps," said NITI Aayog CEO Amitabh Kant.

"I also would like to invite organisations working in this area to collaborate with the Women Entrepreneurship Platform, a NITI Aayog initiative with the aim to overcome information asymmetry, showcase such initiatives and enable women to avail of their benefits," he said while offering the keynote address.